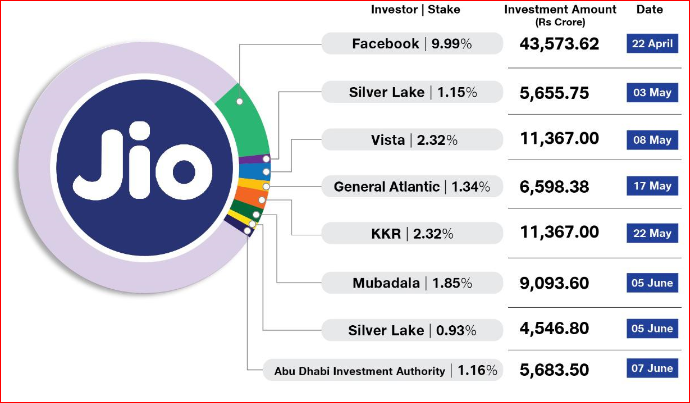

Continuing its almost improbable run, Reliance Industries' digital subsidiary Jio Platforms on Sunday got $750 million (Rs 5,683.50 crore) from Abu Dhabi Investment Authority (ADIA) -- its 7th big-ticket investor in as many weeks.Analysts are astonished at the pace of investment flowing into Jio Platforms especially at the height of global financial turmoil.Jio Platforms has now snared nearly $13 billion from seven investors, including the social media behemoth Facebook, by selling over 20% stake.ADIA, one of the worlds largest investors, is the third deal that Jio Platforms has landed for itself this week.Jio Platforms had earlier got $1.2 billion from another Abu Dhabi-based sovereign firm Mubadala.

Further, late last Friday, equity firm Silver Lake chipped in an additional $600 million to increase its stake in Jio to 2.1%.(Image credit: Jio Platforms)ADIA's India gambitADIA's investment values Jio Platforms at an equity value of Rs 4.91 lakh crore and an enterprise value of Rs 5.16 lakh crore.

ADIAs investment will translate into a 1.16% equity stake in Jio Platforms on a fully diluted basis.Established in 1976, ADIA is a globally-diversified investment institution that invests funds on behalf of the Government of Abu Dhabi through a strategy focused on long-term value creation.

ADIA manages a global investment portfolio that is diversified across more than two dozen asset classes and sub-categories.Hamad Shahwan Aldhaheri, Executive Director of the Private Equities Department at ADIA, said: Jio Platforms is at the forefront of Indias digital revolution, poised to benefit from major socioeconomic developments and the transformative effects of technology on the way people live and work."In a press release, he added: "The rapid growth of the business, which has established itself as a market leader in just four years, has been built on a strong track record of strategic execution.

Our investment in Jio is a further demonstration of ADIAs ability to draw on deep regional and sector expertise to invest globally in market leading companies and alongside proven partners.With this investment, Jio Platforms has raised close to $13 billion (Rs 97,885.65 crore) from leading global investors including Facebook, Silver Lake, Vista, General Atlantic andKKR, Mubadala , Silver Lake again, and now Adia in seven weeks.Jio's scorcing paceJio Platforms, with more than 388 million subscribers in its three-and-a-half-year existence, is blazing a hot trail that its competitors are finding it impossible to match.Jio has made significant investments across its digital ecosystem, powered by leading technologies spanning broadband connectivity, smart devices, cloud and edge computing, big data analytics, artificial intelligence, Internet of Things, augmented and mixed reality and blockchain.On the latest investor, Mukesh Ambani, Chairman and Managing Director of Reliance Industries, said, I am delighted that ADIA, with its track record of more than four decades of successful long-term value investing across the world, is partnering with Jio Platforms in its mission to take India to digital leadership and generate inclusive growth opportunities.

This investment is a strong endorsement of our strategy and Indias potential.The stake sales are part of Jio Platforms' parent company RIL's Reliance Industries) plan to be debt-free by March.

Most likely, the target is likely to be achieved by December, with Reliance already securing Rs53,124 crore from a rights issue that closed on 4 June.(You can read everything about Jio Platforms and its various investors in our comprehensive coverage here).CawgtzVZV9Fh4Nq3JikZxf.jpg?#

14

14