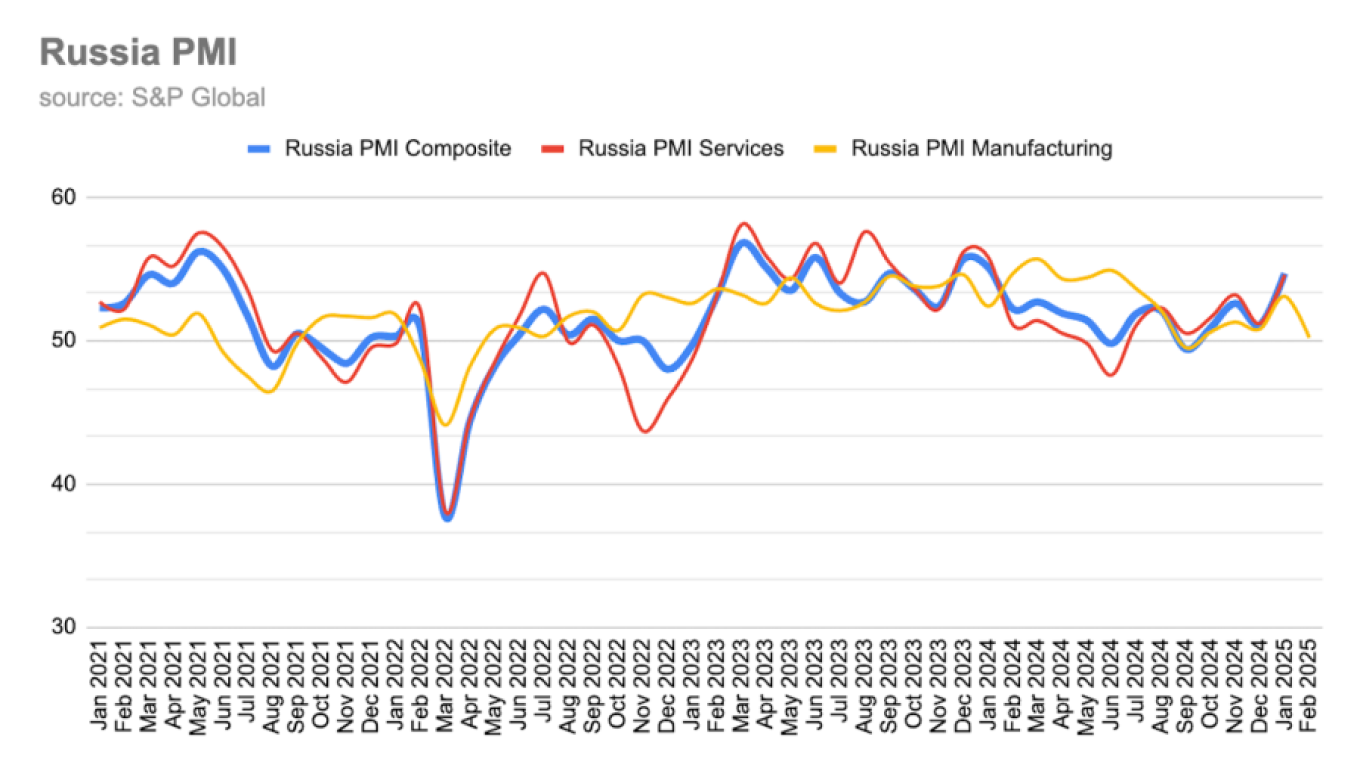

Russias manufacturing sector PMI dropped back to 50.2 in February from 53.1 in January as Russias economy reveals the first concrete indications of cooling, according to the current report by S&P Global launched on Monday.The result significant the slowest expansion in 5 months, S&P Global stated.

The most current information signified just a minor enhancement in the health of the goods-producing sector, and one that was the slowest in the current five-month series of growth, S&P Global said in its report.While some companies reported steady need conditions, others indicated stagnancy in brand-new orders, adding to the weaker performance.The rate of output growth also declined, expanding at just a minimal rate.

This marked the slowest boost in the past 4 months, showing soft demand conditions throughout the sector.

The report kept in mind that new orders had actually broadly stagnated, with the seasonally changed index being up to its most affordable level in 4 months.Russias production PMI dropped from 53.1 in January to just above the no change mark to 50.2 in February as the economy reveals indications of cooling.bne IntelliNewsA PMI reading above 50 indicates a growth in company activity, while a figure below this limit signifies a contraction.The most current data suggest that while Russias making sector remains in development area, momentum has actually slowed significantly in the middle of softening demand.A strong dispute is currently underway among economists with some arguing that the sky-high rate of interest of 21% and sticky inflation of 10% will lead to awave of bankruptcieslater this year, while others say that theRussian economy is more robust than it initially appearsand the chance of a crisis stays low.

A recent paper argued that the state has actually been forcing banks to make soft loans to the defense sector and will cause acredit crisis.However, Central Bank Governor Elvia Nabiullina said that Russias non-performing loans (NPLs) stay at around 4%, a manageable level.Nabiullina informed the State Duma previously this year that hernon-monetary policy methodstocool the economyare working which inflation will fall in the coming months.Analysts concur that relieving of monetary policy is not likely to start this year, unless there is a ceasefire offer on the Ukraine conflict and even then cuts remain unlikely as the Kremlin will likely continue heavy military spending as it requires torebuild its militaryand restock after 3 years of fighting.This short article initially appeared in bne IntelliNews.

20

20