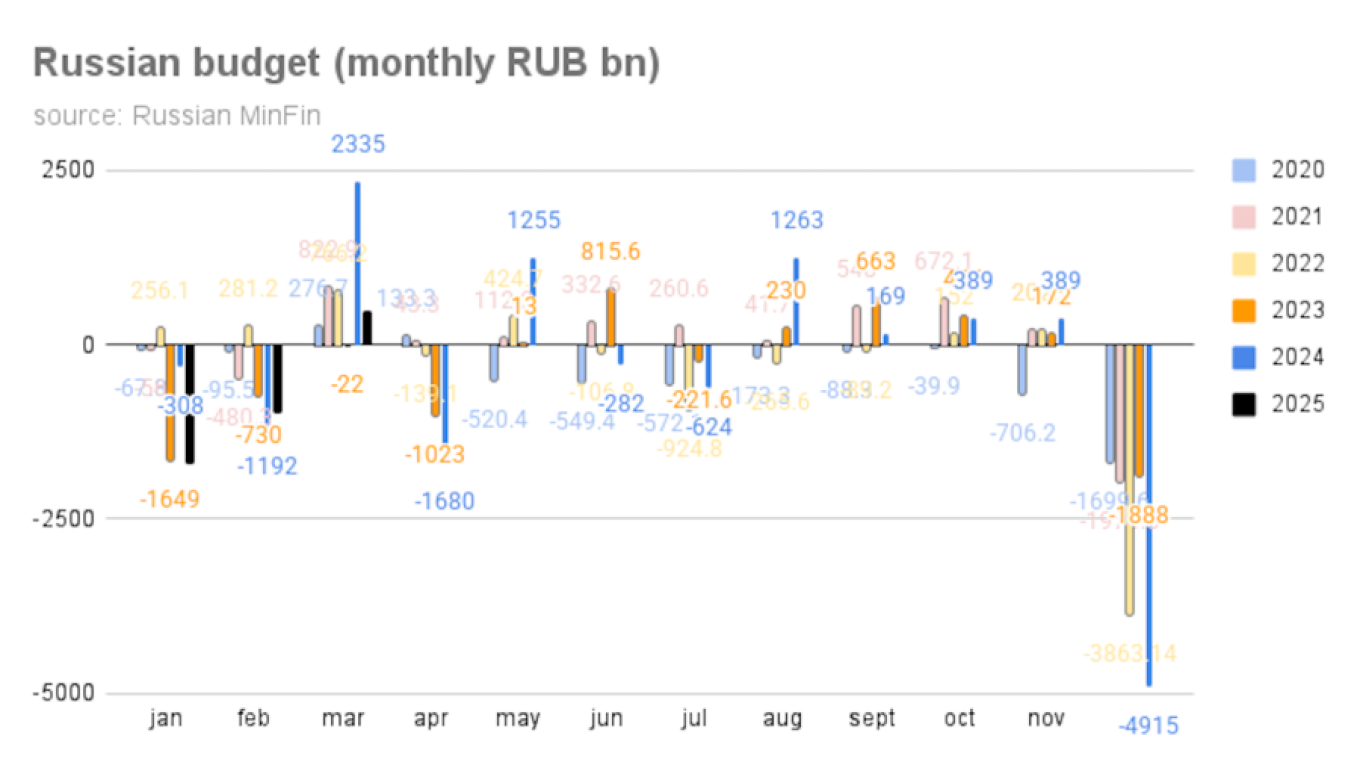

Russia published a 500 billion ruble ($5.4 billion) federal budget surplus in March 2025 amidst falling oil earnings, according to preliminarydatafrom the Finance Ministry.The deficit was equivalent to 1% of GDP, well ahead of the 0.5% deficit target for this year in the spending plan.

However, the Finance Ministry said this week that typical oil costs are expected to come in at less than the $70 in the budget and the deficit was likely to be greater than anticipated.The Finance Ministry missed its target in 2015 as well with a deficit of 1.7% of GDP (minus 3.3 trillion rubles), which was still modest compared to the previous years 1.9% end-of-year result.Previously, thefederal spending plan published an uncommon spike in costs and high deficitsin January and February, which the ministry credited to front-loaded expenses.Despite a surplus taped in March, the cumulative 1Q25 deficit stood at 2.2 trillion rubles ($23.7 billion), equivalent to 1% of GDP.

The full-year budget plan anticipates a 1.2 trillion rubles ($12.9 billion) deficit, or 0.5% of GDP.Russia published a 500 billion ruble ($5.4 billion) spending plan surplus in March, regardless of lower oil costs, or -1% of GDP, well ahead of the 0.5% target for this year.Federal spending plan profits in March amounted to 3.7 trillion rubles ($39.9 billion), flat year-on-year, contributing to a 4% year-on-year (y/y) increase in overall incomes for 1Q25.

Oil and gas incomes declined by 17% y/y in March, while non-oil and gas earnings grew by 10% y/y.

For 1Q25 in general, these earnings groups saw particular changes of -10% and +11% y/y.

Federal budget costs increased by 11% y/y to 3.2 trillion rubles ($34.5 billion) in March, returning to seasonal standards and driving a month-to-month surplus of 500billion rubles ($5.4 billion).

Renaissance Capital experts warn that the increasing possibility of an international recession increases the opportunities of a hard landing for the Russian economy due to falling oil rates.

In such a scenario, a broadening deficit spending would signify continued financial stimulus.They argue, nevertheless, that the inflationary effect of such a stimulus would be milder than in 20222024.

Utilizing National Wealth Fund (NWF) reserves to offset lost oil revenues and increasing obtaining to cover non-oil earnings deficiencies is seen as less inflationary than releasing these funds to increase spending by analysts.This short article initially appeared in bne IntelliNews.

19

19