INSUBCONTINENT EXCLUSIVE:

payment applications boom.The traditional banks and money transfer organizations have thus been forced to create enticing smartphone and

tablet-friendly apps to maintain their user bases, while tech companies not previously associated with financial services have also been

entering the fray, smelling an increasingly profitable opportunity amid a rapidly changing landscape.With a plethora of money transfer apps

other side of the world, and everything in between.1

individual users and businesses winning via its money transferring app

While the everyday user can make quick and simple payments via their phone, businesses are able to give an increasingly mobile-first

audience a smooth, handheld checkout on purchases

A big ecommerce box ticked

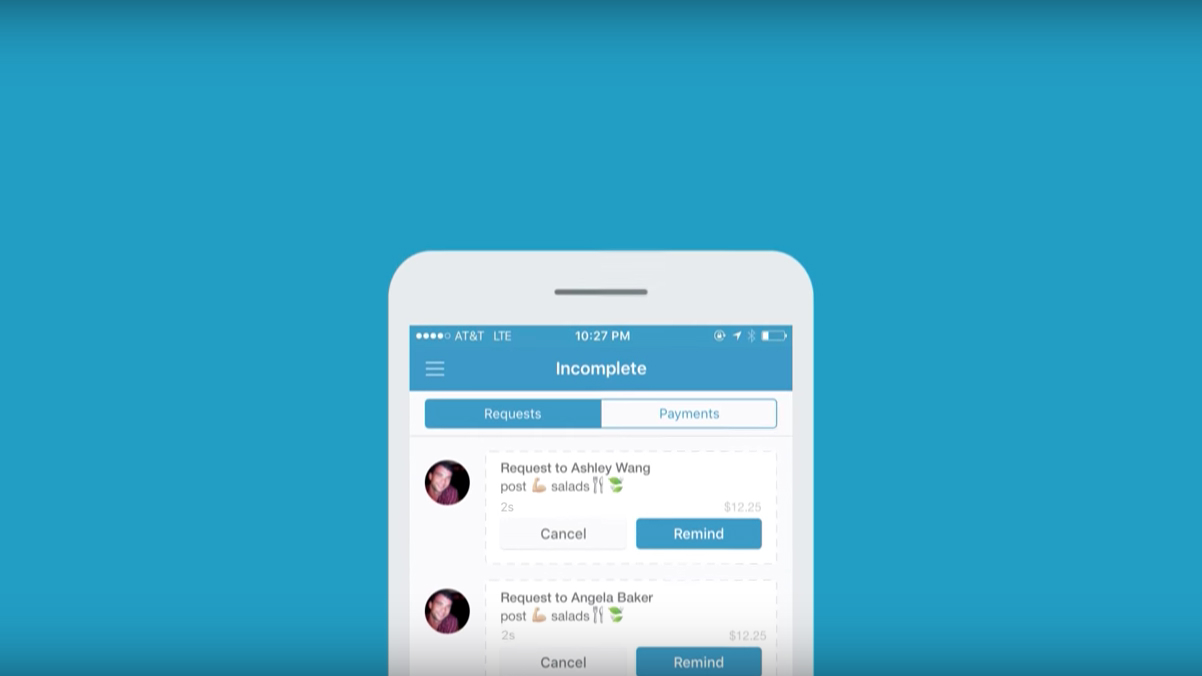

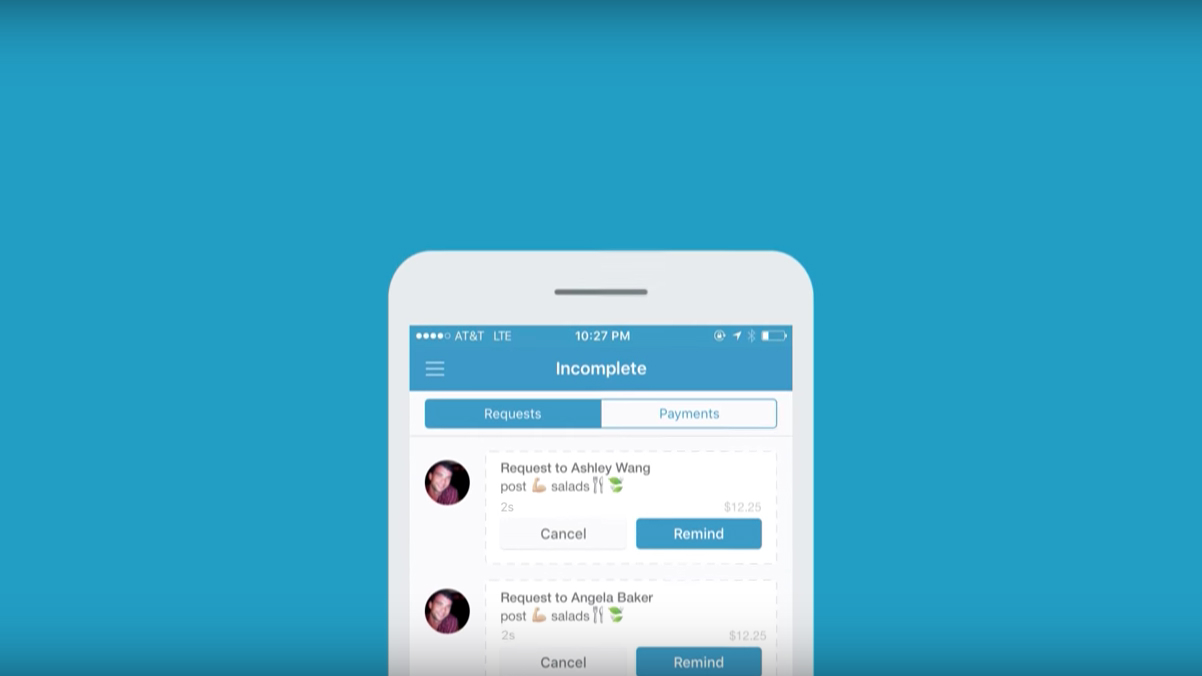

stored within their Venmo account

These transfers can be stored as a Venmo balance to be used later or cashed out immediately to a bank account.With its slick UI and

all-round convenience winning favor among millennials, businesses seeking to tap this younger market will increasingly consider wrapping

Venmo into their payment systems, and they can do so in the knowledge that it safeguards payment data with encryption for maximum safety and

likely Western Union is one of the first names that springs to mind when you think of money transfers, so it should be of little surprise

average mobile user has shrunk to that of a gnat, so time-consuming entry fields to insert your details have been scrapped where possible

If your phone has Touch ID, you can get your transfer rolling with a press of your thumb, while a card scanning feature spares you the

16-digit input haul on setup

pickup, mobile credit or an airtime top-up

Best of all, processing time is just a matter of minutes, making for near instant availability at the other end

governments across the world.Charges on your transfer depend on the sum of money and also the destination

That said, your first transfer with WorldRemit is free of charge, so why not give it a go4

up-to-date on the status of your transaction via the app

But while the technology in money transfer services usually takes care of itself, the bureaucracy around collecting bank and cash payments

destination, the fees are very reasonable, and the service can count on over 200,000 pick-up points worldwide

The customer service is strong too, even if it is restricted to email rather than phone

it comes to domestic transfers

if quick peer-to-peer transfers are more important to you than international transactions, those debit card fees may push you towards its

cool little sibling, Vemno

latest iteration of its money transfer app

The platform allows you to make secure purchases in stores, in apps, and on the web, and you can now send and receive money in Messages too

First came its instant peer-to-peer payments, then came a business-friendly extension to the service, and now it even supports Bitcoin

In addition to speedy international transfers from your mobile, the app offers live insight and commentary on market rates and can count on

very solid customer service thanks to its support teams in Australia, US, UK, Canada, New Zealand, Hong Kong and Singapore