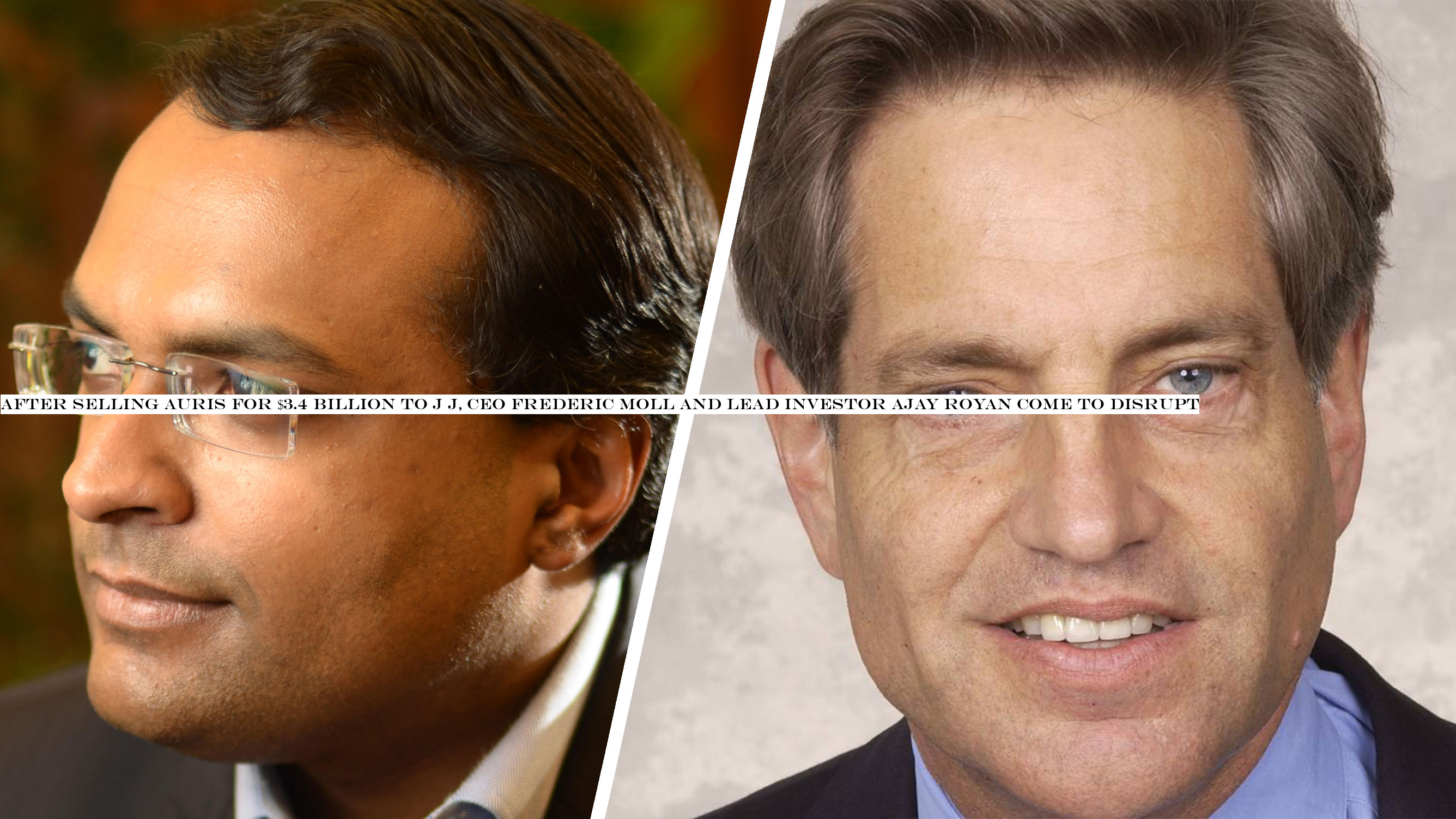

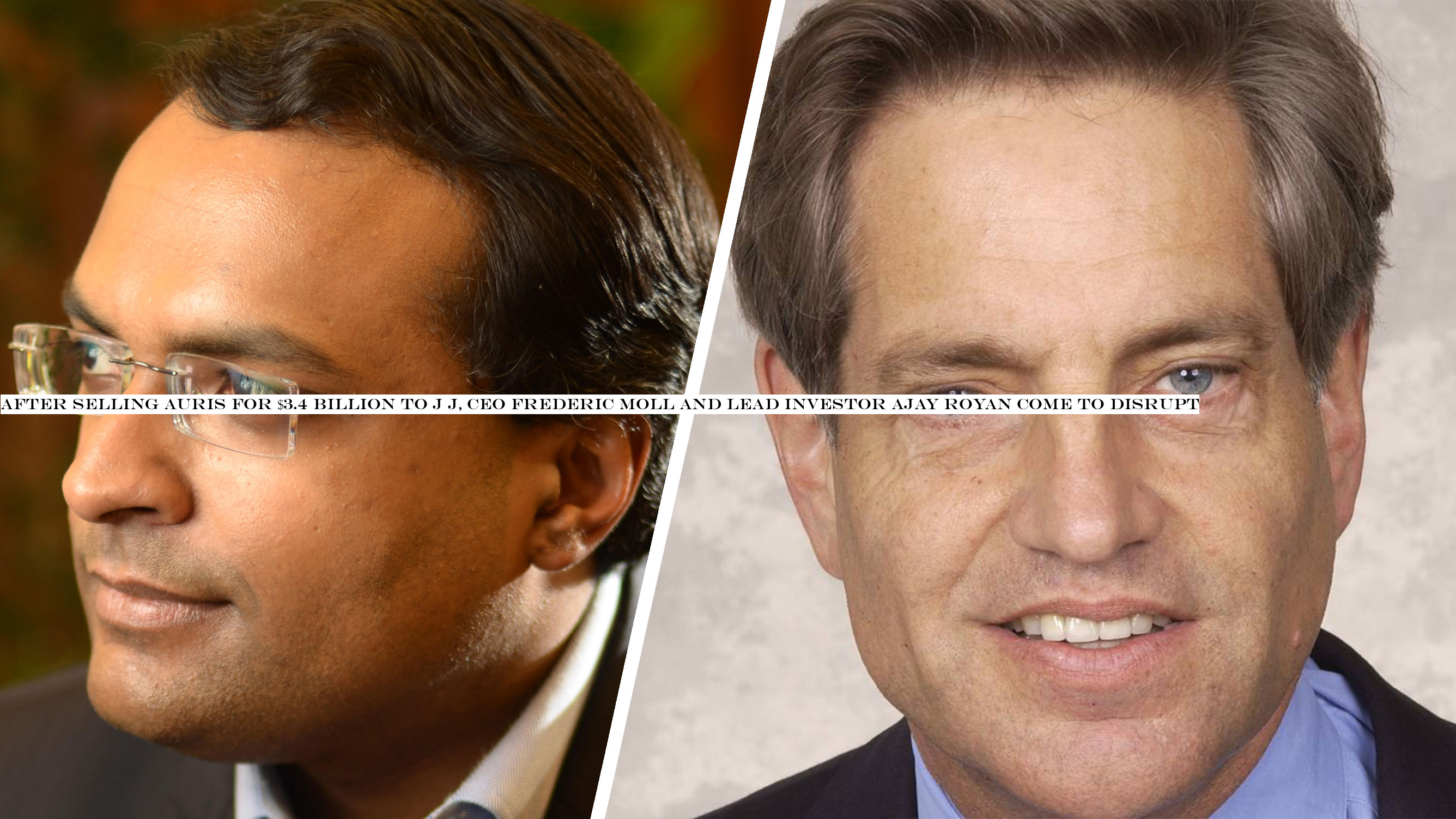

INSUBCONTINENT EXCLUSIVE:

a company that developed tools to manipulate catheters.Most recently, the serial medical device entrepreneur sold Auris, a manufacturer of

advanced surgical robots that was sold earlier this year to Johnson - Johnson in a $3.4 billion deal that also holds the possibility of an

additional $2.35 billion in payouts.More significant than the money, though, are the changes that technologies like Auris presage for the

in an interview with Fortune earlier this year

very intuitive and simple fashion? That was the thesis behind Auris; it was not an instrument that we were funding, we were funding a

It led Mithril to back the company and paved the way for what looks like a $700 million windfall for the fund.Mithril closed its second fund

with $850 million roughly two years ago and has been methodically investing in a wide range of companies that include the intelligence data

mining company Palantir, along with big swings in robotics companies around the world.Mithril invested $140 million into a Singapore and

Gurugram-based startup, GreyOrange, and the Miami-based dental surgical robotics company, Neocis.Expect to hear updates on investment in

robotics, disruptions in the medical device world and much, much more at Disrupt SF in October when these two titans take the stage.Disrupt

Tickets are available here.