INSUBCONTINENT EXCLUSIVE:

Michael Proman

Contributor

Michael Proman is managing director at Scrum Ventures

.

Sports have

always been the ultimate unifier — transcending geographic borders, rising above partisan politics and enabling multiple audiences (and

generations) to find alignment — the little-known secret behind this global unifier? Technology.

Technology influences how athletes train

and compete, how fans engage and consume content and how world-class venues are constructed

Technology has been quietly transforming the world of sports for years, with investment in areas like esports continuing to rise, surpassing

a total of $2.5 billion in VC funding in 2018 — and some estimates predicting the sports tech sector will reach $30 billion by 2024.

With

the 2020 Tokyo Olympics less than a year away, a massive amount of investment and innovation are pouring into the sports technology industry

ahead of this globally unifying event

But which technologies are making the biggest impact? Where are investors placing their bets? Which sports are at the forefront of the

technology revolution and which factors are holding the industry back?

In an attempt to pull the curtain back on the sports tech industry,

we conducted a survey,The Current State of Sports Technology, of industry experts, including investors, founders and professionals from

teams, leagues and media properties, to answer these very questions

Below you&ll find some key takeaways from our findings, pointing to the areas we believe the industry is headed in the year to come.

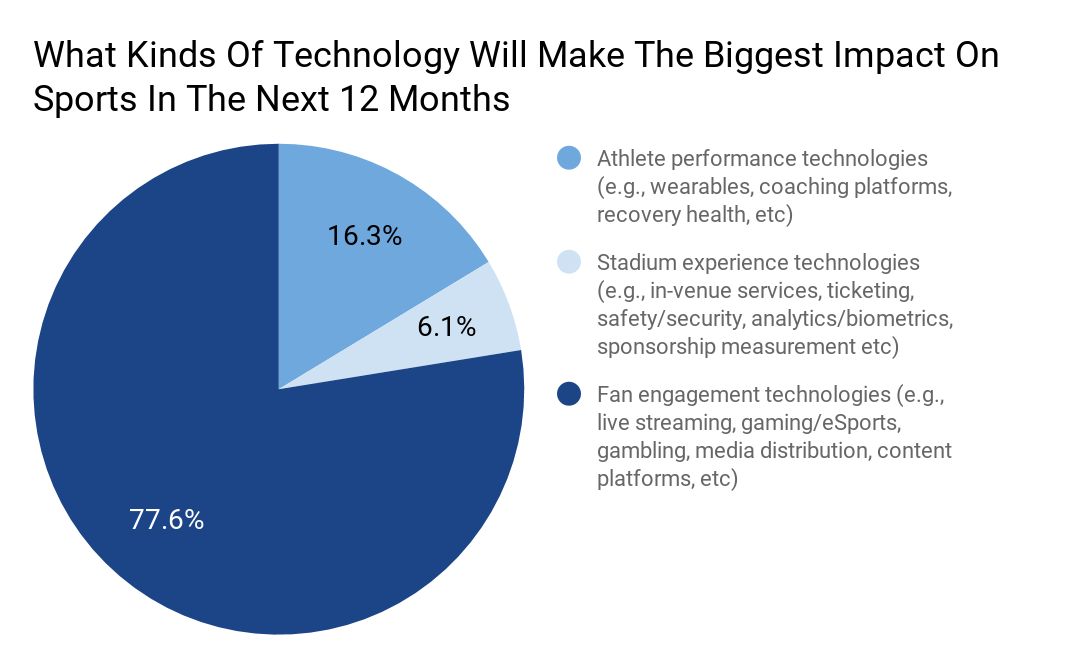

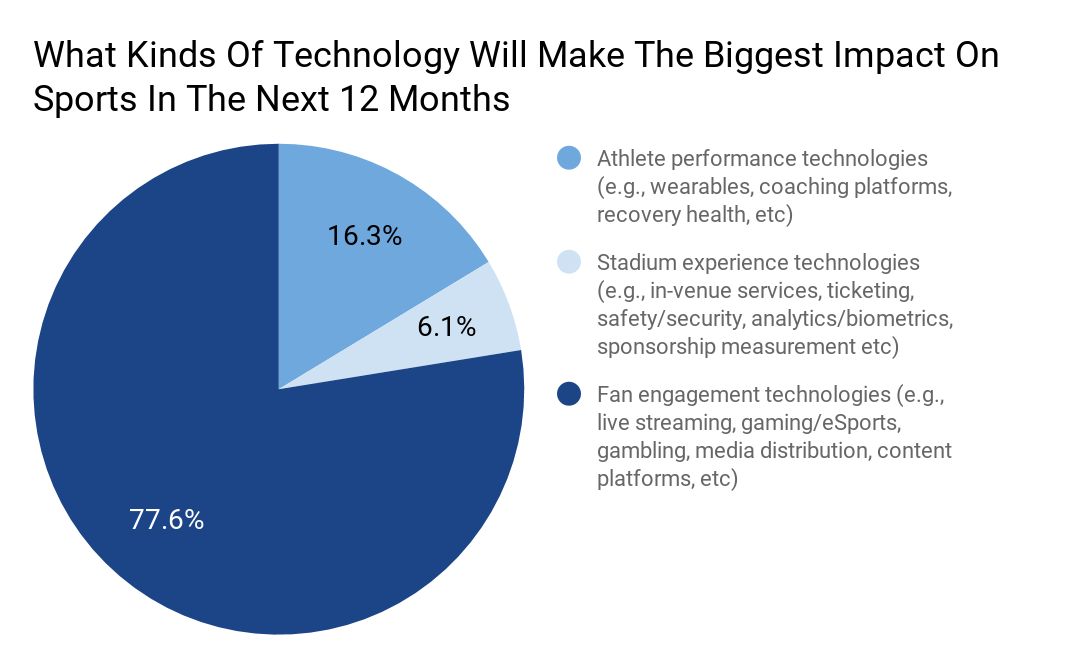

Fan

engagement technologies, including live streaming and esports, are set to make the largest impact on sports in the next 12 months

When asked

about which technologies would make the biggest impact on the sports industry in the next 12 months, an overwhelming 78% selected fan

engagement technologies, such as live streaming, esports and content platforms, compared to technologies related to athlete performance

(16%) and stadium experience (6%)

Respondents also believe that this will hold true for the upcoming 2020 Olympic Games in Tokyo.

Anticipating the next fan engagement trend

is critical, whether you&re a team, brand or media company,& says Tom Masterman, global head of Publisher Sales at Genius Sports Media, a

leading provider of sports data and technology solutions

&Tokyo 2020 will be a make-or-break event for startups as well as incumbent technologies.

Having worked on two Olympics at previous digital

media companies, Masterman is aware of how quickly the Games come and go

&Among the questions that will keep many of us up at night include, ‘Will fans adopt my tech? Is my sponsorship integration a good

experience? Did I choose the right channel partners?&

Top three technologies for investment: Media and content-related platforms;

measurement platforms for data, analytics and biometrics; and esports

From an investment perspective, media and content-related platforms,

esports and measurement platforms for data, analytics and biometrics were among the top three areas of interest

Other notable areas include athlete tech and performance optimization, in-venue technology, gambling and gaming and recovery health and home

This is a powerful indication of where venture capital funding focus is trending, given that more than 50% of respondents, coming from a

wide array of areas in the industry, identified themselves as investors.

As investors, we see cyclicality in every industry except sports,

which has the biggest consumer ecosystem

Sports had been a very traditional industry powered by legacy tech, but now with the advent of streaming, sports content media distribution

is decentralized via social media platforms,& says Gayatri Sarkar, managing partner at Hype Capital, who offered her take on this investment

&The sports market has the opportunity to be a multitrillion-dollar ecosystem with technological advances such as 5G, digital collectible

trading and the rise of esports, which will fuel new market and social behavior.As the infusion of deep tech continues in smart venue,

gambling, performance biometrics and many more sub verticals where data is the engine, we&ll naturally see more and more deep tech investors

entering the sports investment landscape.

Basketball and esports are at the forefront of technology

While esports is a likely leader in the

use of technology, with 79% of respondents placing it in the top three category, basketball remains the top pick, with 87% placing the

traditional sport at the forefront of innovation.

As a former NBA-er*, this comes as no big surprise

The league has always been known as a thought-leader in technology and innovation, and their dominance is what is driving the sport

tech-savvy DNA on a global level.

When talking to Tom Hunt, EVP, Business Operations at the Sacramento Kings about his take on innovation in

the NBA, he placed technology as a top priority.Golden 1 Center is one of the most technologically advanced and connected indoor arenas in

the world, and serves as our 21st Century communal fireplace,& said Hunt

&We&ve been at the forefront of leveraging technologies such as AI, AR, blockchain and esports (Kings Guard Gaming/NBA 2K) to deepen

connections to our brands while customizing and personalizing frictionless fan experiences remains core to our mission.

That being said, I&d

make a bet that baseball-related technology will catch up very quickly

We&ve seen several startups currently working with baseball clubs — enhancing everything from a player cognitive reactions to the ways in

which your food is delivered to you at ballparks.

What holding back sports tech adoption?

Respondents cited several factors holding back

sports technology adoption, with the top three reasons, similar to many non-traditional technology sectors, being unqualified decision

makers, risk aversion and cost.

While there plenty of blame to go around (and everyone can assume a degree of responsibility), startups in

the space need to validate their business model outside of a core sports stakeholder

They need to realize revenue from more than just sports teams, leagues and properties — organizations that have historically reinforced

the leading responses to this question

More importantly, relationships with these audiences require long sales cycles and traditionally represent ¢s on the dollar& in

comparison to partnerships with other industry (e.g

brands) and non-industry (e.g

military, retail, airline, etc.) opportunities.

Parting thoughts

The sports tech industry has and continues to suffer from massive amounts

Whether it be by geography, industry area of focus or funding stage, sports tech startups are missing the community that it has enabled

others to realize.

There is a historic opportunity to bring this community together, and when we do, the legacy that we create will be one

of continued growth and opportunity — perpetuating the currentinflux of capitalinto the space andreinforcing the notion that sports are

truly the ultimate unifier.

*I worked for the NBA for more than four years in Global Business Development.