INSUBCONTINENT EXCLUSIVE:

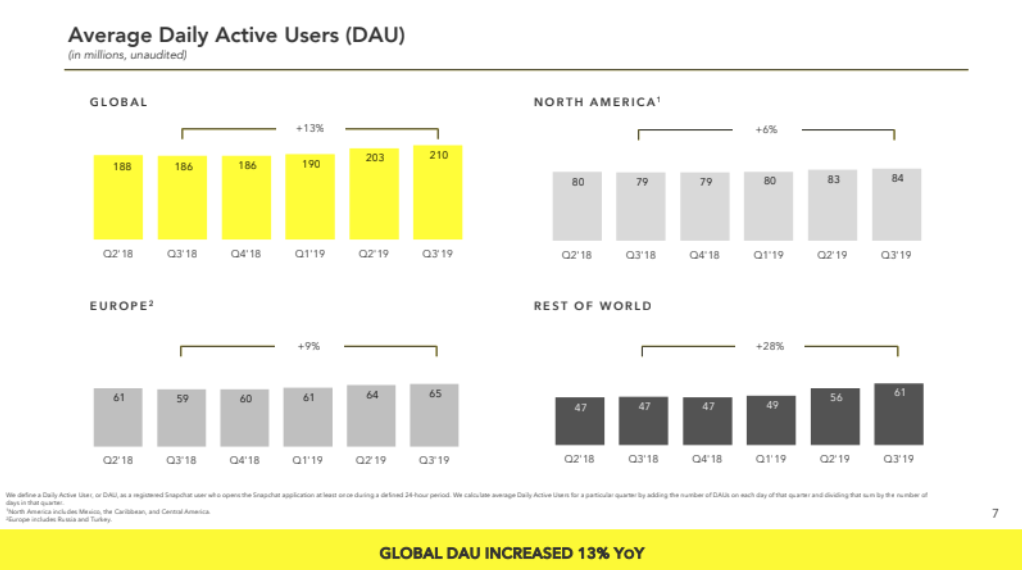

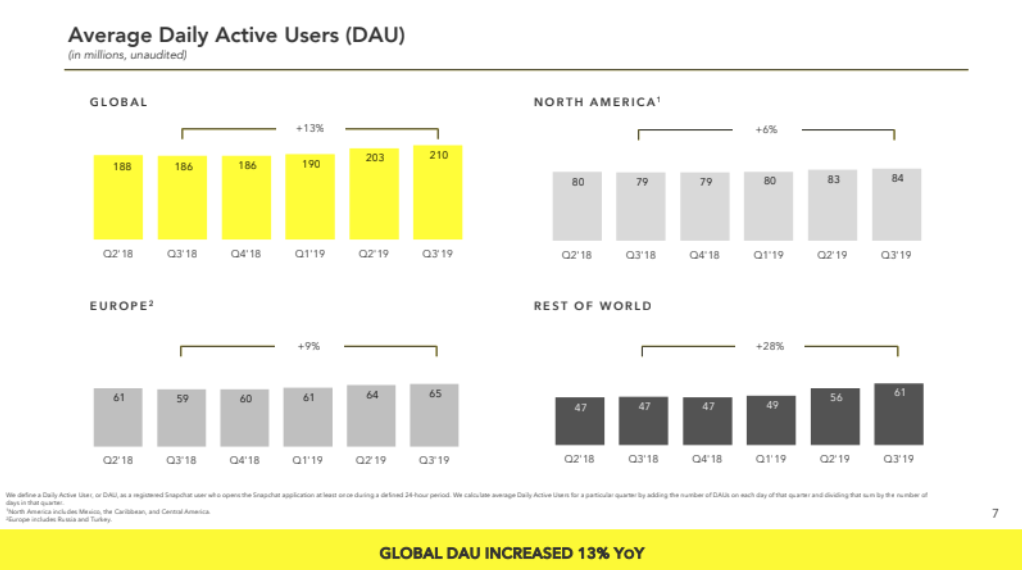

Snapchat blew past earnings expectations for a big beat in Q3, as it added 7 million daily active users this quarter to hit 210 million, up

Snap also beat on revenue, notching $446 million, which is up a whopping 50% year-over-year, at a loss of $0.04 EPS

That flew past Bloomberg consensus of Wall Street estimates that expected $437.9 million in revenue and a $0.05 EPS loss.

Snap has managed

to continue cutting losses as it edges toward profitability

Net loss improved to $227 million from $255 million last quarter, with the loss decreasing $98 million versus Q3 2018.

CEO Evan Spiegel

made his case in his prepared remarks for why Snapchat share price should be higher: &We are a high-growth business, with strong operating

leverage, a clear path to profitability, a distinct vision for the future and the ability to invest over the long term.&

Snapchat share

price had closed down 4% at $14, and had fallen roughly 4.6% in after-hours trading as of 1:50 pm Pacific, to $13.35, despite the earnings

It remains below its $17 IPO price but has performed exceedingly well this year, rising from a low of $4.99 in December.

That partially

because of the high cost of Snapchat growth relative average revenue per user

While it notes that it saw user growth in all regions, 5 million of the 7 million new users came from the Rest of World, with just 1 million

coming from the North America and Europe regions

That in part thanks to better than expected growth and retention on its re-engineered Android app that been a hit in India

But since Snapchat serves so much high-definition video content but it earns just $1.01 average revenue in the Rest of World, it has to hope

it can keep growing ARPU so it becomes profitable globally.

Some other top-line stats from Snapchat earnings:

Operating cash flow improved

by $56 million to a loss of $76 million in Q3 2019, compared to the prior year.

Free Cash Flow improved by $75 million to $84 million in Q3

2019, compared to the prior year.

Cash and marketable securities on hand reached $2.3 billion.

Interestingly, Spiegel noted that &We

benefited from year-over-year growth in user activity in Q3 including growth in Snapchatters posting and viewing Stories.& Snapchat hadn&t

indicated Stories was growing in at least the past two years, as it was attacked by clones, including Instagram Stories that led Snapchat to

start shrinking in user count a year ago before it recovered.

Since Stories viewership is critical to total ad view on Snapchat, we may see

analysts insisting to hear more about that metric in the future

Snap also said users opened the app 30 times per day, up from 25 times per day as of July 2018, showing it still highly sticky and being

used for rapid-fire visual communication.

The other major piece of Snapchat ad properties is Discover, where total time spent watching grew

And rather than being driving by just a few hits, more than 100 Discover channels saw over 10 million viewers per month in Q3

With Instagram IGTV a flop, Discover remains Snapchat best differentiated revenue driver, and one it needs to keep investing in and

With Instagram trying to compete more heavily on chat with its new close friends-only Threads app, Snapchat can&t rely on ephemeral

messaging to keep it special.

TikTok buys ads on Snapchat that could steal its users

Surprisingly, Spiegel said that &We definitely see

TikTok as a friend& when asked about why it allowed the competitor to continue buying ads on Snapchat

The two apps are different, with Snapchat focused on messaging and biographical social media while TikTok is about storyboarded,

premeditated social entertainment

But this could be a dangerous friendship for Snapchat, as TikTok may be taking time away that users might spend watching Snapchat Discover,

and its growth could box Snapchat out of the social entertainment space.

Looking forward, in Q4 Snap is estimating 214 to 215 million daily

active users and $540 million to $560 million in revenue

It expecting between break even and positive $20 million for adjusted EBITDA

That revenue guidance was below estimates for the holiday Q4, contributing to the share price fall.

Snap has a ways to go before reaching

That milestone would let it more freely invest in long-term projects, specifically its Spectacles camera-glasses

Spiegel has said he doesn&t expect augmented reality glasses to be a mainstream consumer product for 10 years

That means Snap will have to survive and spend for a long time if it wants a chance to battle Apple, Facebook, Magic Leap and more for that