INSUBCONTINENT EXCLUSIVE:

Despite ongoing public relations crises, Facebook kept growing in Q3 2019, demonstrating that media backlash does not necessarily equate to

poor business performance.

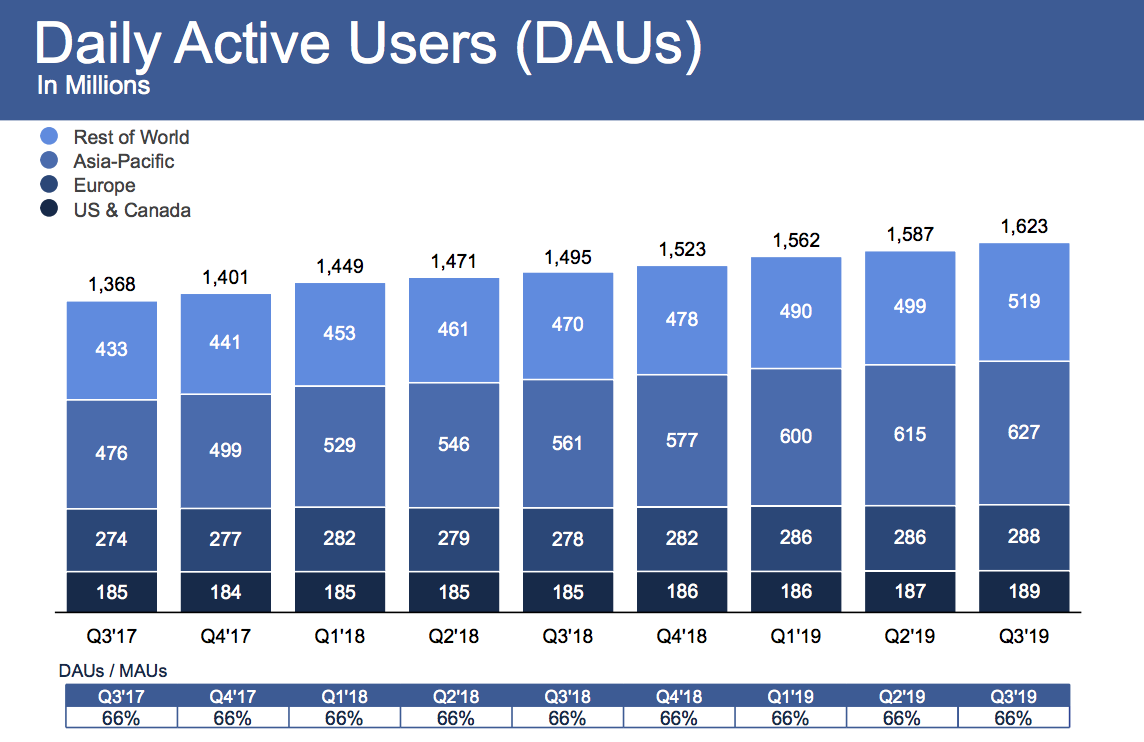

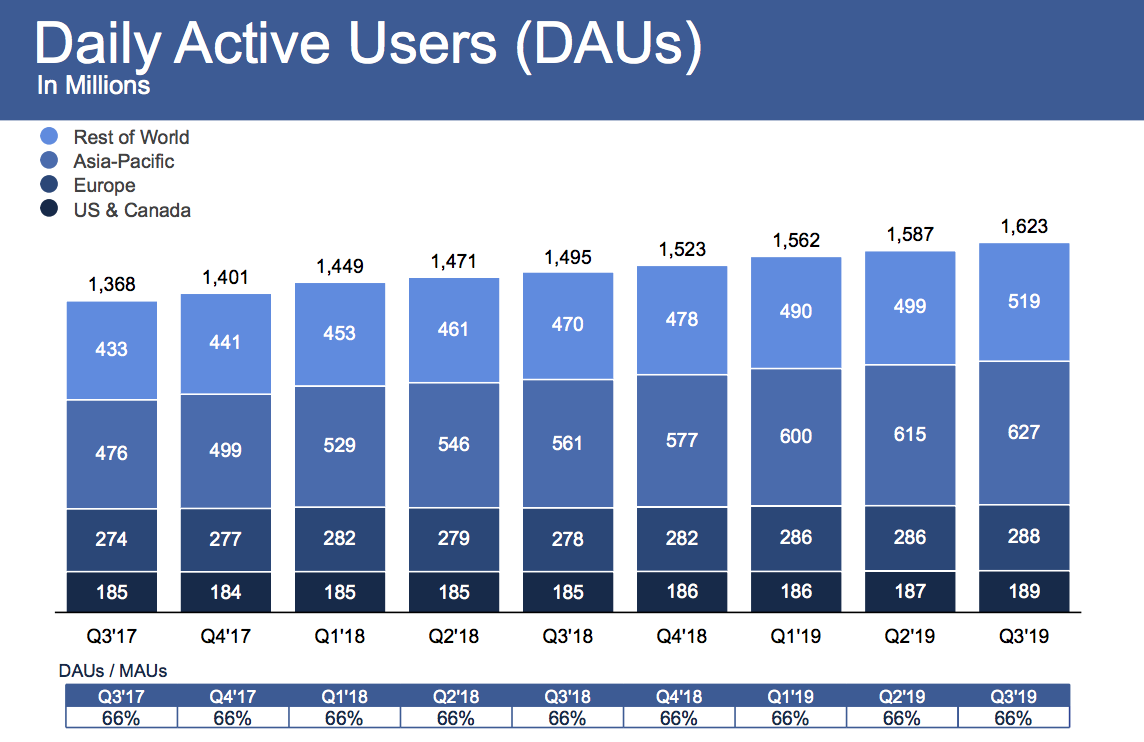

Facebook reached 2.45 billion monthly users, up 1.65%, from 2.41 billion in Q2 2019 when it grew 1.6%, and it now

has 1.62 billion daily active users, up 2% from 1.587 billion last quarter when it grew 1.6%

Facebook scored $17.652 billion of revenue, up 29% year-over-year, with $2.12 in earnings per share.

Facebook earnings beat expectations

compared to Refinitiv consensus estimates of $17.37 billion in revenue and $1.91 earnings per share

Facebook quarter was mixed compared to Bloomberg consensus estimate of $2.28 EPS

Facebook earned $6 billion in profit after only racking up $2.6 billion last quarter due to its SEC settlement.

Facebook shares rose 5.18%

in after-hours trading, to $198.01 after earnings were announced, following a day where it closed down 0.56% at $188.25.

Notably, Facebook

gained 2 million users in each of its core U.S

- Canada and Europe markets that drive its business, after quarters of shrinkage, no growth or weak growth there in the past two years

Average revenue per user grew healthily across all markets, boding well for Facebook ability to monetize the developing world where the bulk

of user growth currently comes from.

Facebook says 2.2 billion users access Facebook, Instagram, WhatsApp or Messenger every day, and 2.8

billion use one of this family of apps each month

That up from 2.1 billion and 2.7 billion last quarter

Facebook has managed to stay sticky even as it faces increased competition from a revived Snapchat, and more recently TikTok

However, those rivals might more heavily weigh on Instagram, for which Facebook doesn&t routinely disclose user stats.

Zuckerberg defends

political ads policy

Facebook earnings announcement was somewhat overshadowed by Twitter CEO Jack Dorsey announcing it would ban all

political ads — something TechCrunch previously recommended social networks do

That move flies in the face of Facebook CEO Mark Zuckerberg staunch support for allowing politicians to spread misinformation without

fact-checks via Facebook ads

This should put additional pressure on Facebook to rethink its policy.

Zuckerberg doubled-down on the policy, saying &I believe that the

better approach is to work to increase transparency

Ads onFacebook are already more transparent than anywhere else,& he said

Attempting to dispel that the policy is driven by greed, he noted Facebook expects political ads to make up &less than 0.5% of our revenue

next year.& Because people will disagree and the issue will keep coming up, Zuckerberg admitted it going to be &a very tough year.&

Facebook

also announced that lead independent board member Susan D

Desmond-Hellmann has resigned to focus on health issues.

Zuckerberg defends political ads that will be 0.5% of 2020 revenue

Earnings call

highlights

Facebook expects revenue deceleration to be pronounced in Q4

But CFO David Wehner provided some hope, saying &we would expect our revenue growth deceleration in 2020 versus the Q4 rate to be much less

pronounced.& That led Facebook share price to spike from around $191 to around $198.

However, Facebook will maintain its aggressive hiring

While the company has touted how artificial intelligence would increasingly help, Zuckerberg said that hiring would continue because

&There&s just so much content

We do need a lot of people.&

Regarding Libra regulatory pushback, Zuckerberg explained that Facebook was already diversified in commerce

if that doesn&t work out, citing WhatsApp Payments, Facebook Marketplace and Instagram shopping.

On anti-trust concerns, Zuckerberg reminded

analysts that Instagram success wasn&t assured when Facebook acquired it, and it has survived a lot of competition thanks to Facebook

In a new talking point we&re likely to hear more of, Zuckerberg noted that other competitors had used their success in one vertical to push

others, saying &Apple and Google built cameras and private photo sharing and photo management directly into their operating

systems.&

Scandals continue, but so does growth

Overall, it was another rough quarter for Facebook public perception as it dealt with

outages and struggled to get buy-in from regulators for its Libra cryptocurrency project

Former co-founder Chris Hughes (who I&ll be leading a talk with at SXSW) campaigned for the social network to be broken up — a position

echoed by Elizabeth Warren and other presidential candidates.

The company did spin up some new revenue sources, including taking a 30% cut

of fan patronage subscriptions to content creators

It also trying to sell video subscriptions for publishers, and it upped the price of its Workplace collaboration suite

But gains were likely offset as the company continued to rapidly hire to address abusive content on its platform, which saw headcount grow

28% year-over-year, to 43,000

There are still problems with how it treats content moderators, and Facebook has had to repeatedly remove coordinated misinformation

Appearing concerned about its waning brand, Facebook moved to add &from Facebook& to the names of Instagram and WhatsApp.

It escaped with

just a $5 billion fine as part of its FTC settlement that some consider a slap on the wrist, especially since it won&t have to significantly

But the company will have to continue to invest and divert product resources to meet its new privacy, security and transparency requirements

These could slow its response to a growing threat: Chinese tech giant ByteDance TikTok.

Zuckerberg misunderstands the huge threat of