INSUBCONTINENT EXCLUSIVE:

Noted Silicon Valley venture capital fund Sequoia Capital has raised nearly $1 billion for later-stage U.S

investments and roughly $2.4 billion for venture and growth deals in China, according to paperwork filed with the U.S

Securities and Exchange Commission on Tuesday.The firm, famous for its investments in U.S

the national leaders in the development of machine learning applications.These investments have not come without their share of controversy

Yitu has been linked to the technology dragnet currently in place in Xinjiang, where an estimated 1 million religious and ethnic minorities

senators have already called for an investigation into TikTok, and Yitu was blacklisted by the U.S

Department of Commerce in October for its role in human rights violations in Xinjiang.Setting politics aside, Sequoia has brought in $1.8

billion for its Sequoia Capital China Growth Fund V and about $550 million for Sequoia Capital China Venture Fund VII, per filings with the

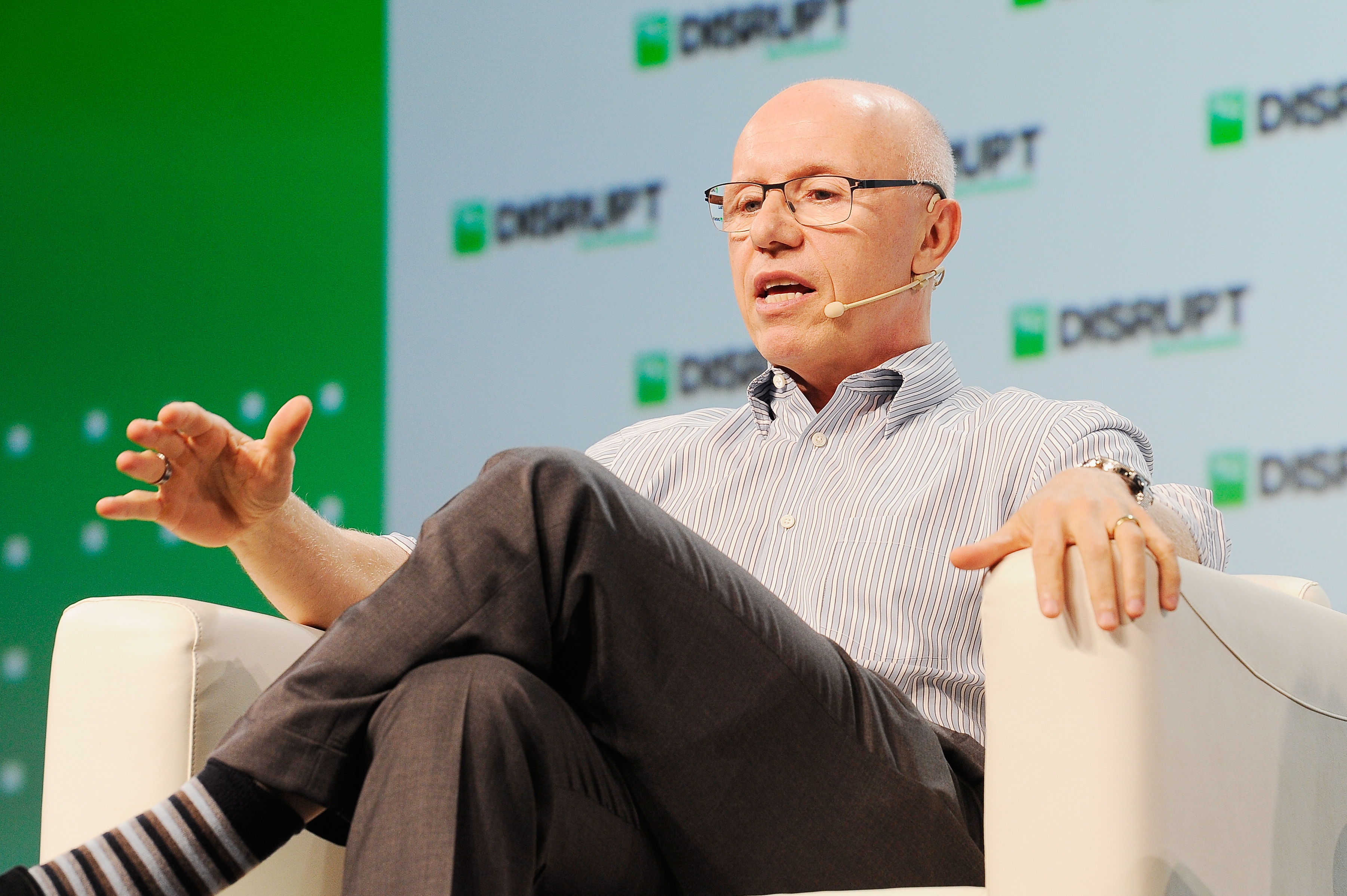

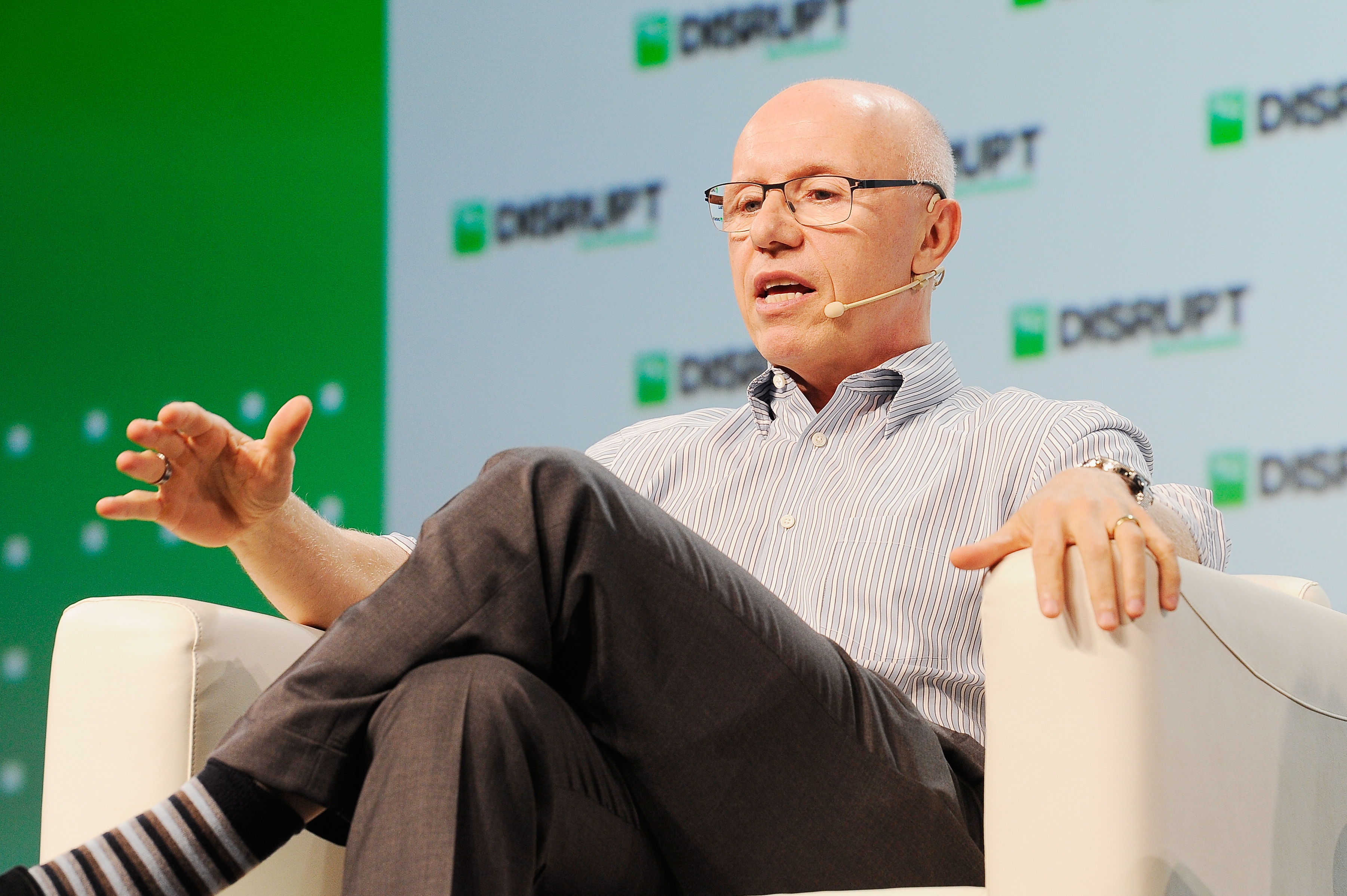

some reports), investors can overlook the potential political pitfalls of dealing with China.Sequoia, led by Doug Leone, Michael Moritz,

Roelof Botha and others, recently sought $8 billion for a global fund, its largest-ever fundraise, holding a first close of $6 billion in

In addition, the firm operates Sequoia Capital India, with offices in Menlo Park, Bengaluru, Mumbai, New Delhi, Singapore, Tel Aviv,

Beijing, Hong Kong and Shanghai.News of the fund comes at the tail end of another strong year for venture capital fundraising in the U.S

Firms, including 41-year-old NEA, filed to raise as much as $3.6 billion for a single fund

Meanwhile, Norwest Venture Partners, DCVC and Accel all closed new vehicles exceeding $500 million.