INSUBCONTINENT EXCLUSIVE:

Financial services startups raised less money in 2019 than they did in 2018 as VC firms looked to back late stage firms and focused on

developing markets, a new report has revealed.

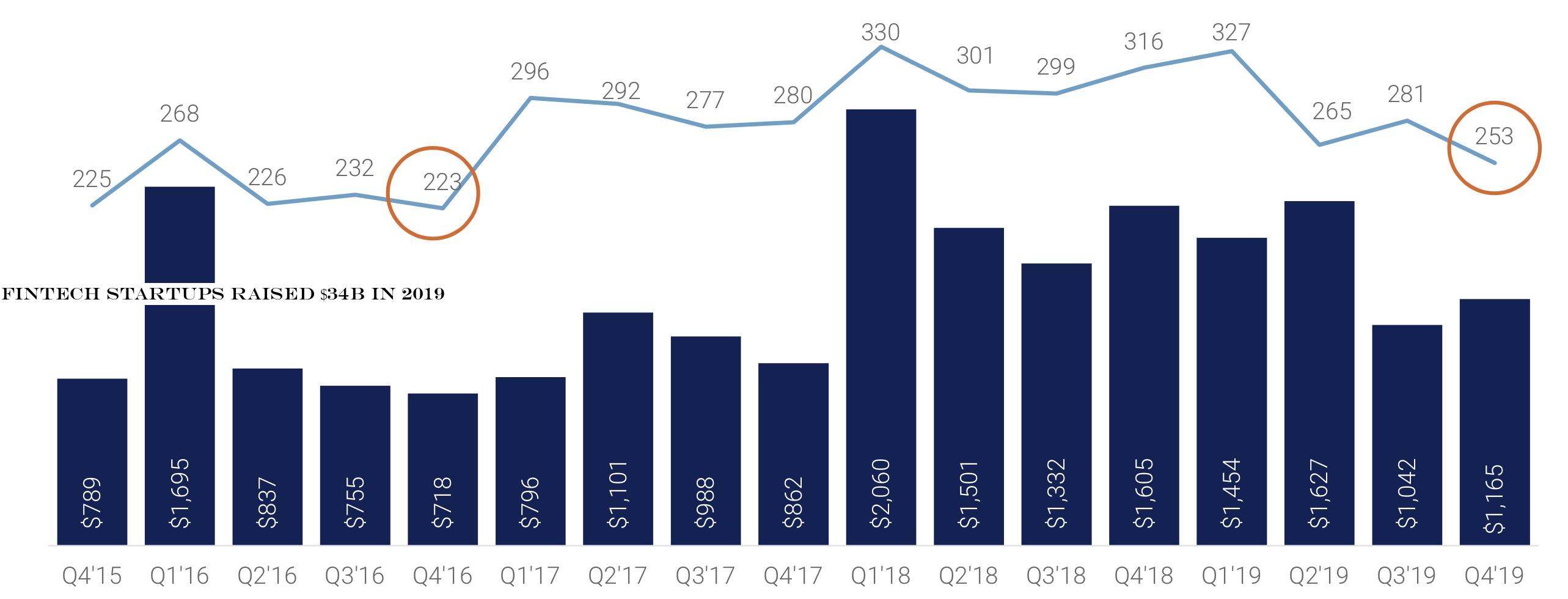

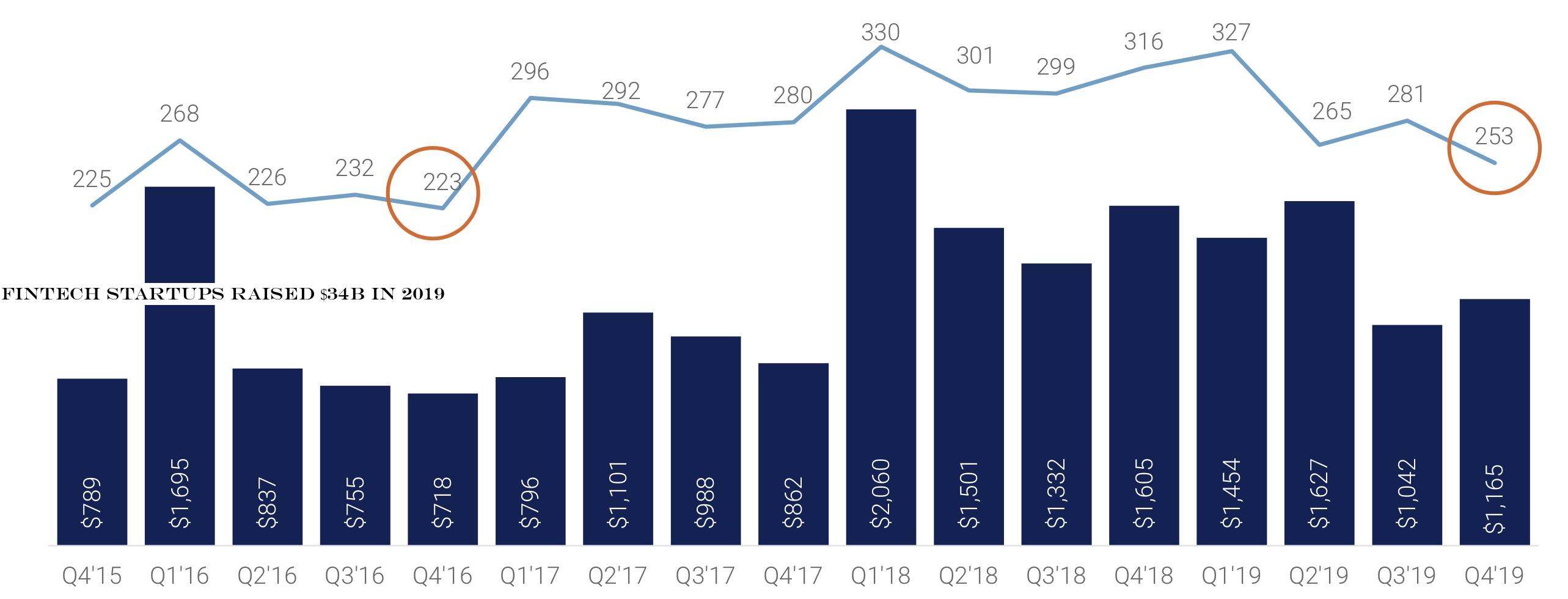

According to research firm CB Insights& annual report published this week, fintech startups

across the world raised $33.9 billion* in total last year across 1,912 deals*, down from $40.8 billion they picked up by participating in

2,049 deals the year before.

It a comprehensive report, which we recommend you read in full here (your email is required to access it), but

below are some of the key takeaways.

Early stage startups struggled to attract money: Per the report, financing for startups looking to

close Seed or Series A dropped to a five-year low in 2019

On the flip side, money pouring into Series B or beyond startups was at record five-year high.

Early-stage deals dropped to a 12-quarter

low as deal share globally shifts to mid- and late-stages (CB Insights)

Emerging and frontier markets were at the centre stage of the most

of the action: South America, Africa, Australia, and Southeast Asia all topped their annual highs last year.

Asia outpaced Europe in the

second half of last year on both number of deals and bulk of capital raised

In Q3, European startups raised $1.6 billion through 95 deals, compared to $1.8 billion amassed by Asian startups across 157 deals

In Q4, a similar story was at play: European startups participated in 100 rounds to raise $1.2 billion, compared to $2.14 billion* raised by

Asian startups across 125 deals*.

Emergence of 24 new fintech unicorns in 2019: 8 fintech startups including Next Insurance, Bight Health,

Flywire, High Radius, Ripple, and Figure attained the unicorn status in Q4 2019, and 16 others made it to the list throughout the rest of

the last year.

The fintech market globally today has 67 unicorns as of earlier this month (CB Insights)

Insurtech sector, or startups such

as Lemonade, Hippo, Next, Wefox, Bright Health that are offering insurance services, got a major boost last year

They raised 6.2 billion last year, up from $3.2 billion in 2018.

Startups building solutions such as invoicing and taxing services and

payroll and payments solutions for small and medium businesses also received the nod of VCs

alone, where more than 140 startups are operating in the space, raised $4 billion

In many more markets, such startups are beginning to emerge

In India, for instance Open and NiYo are building neo-banks for small businesses and they both raised money last year.

Nearly 50% of all

funding to fintech startups was concentrated in 83-mega rounds (those of size $100 million or above.): According to the research firm, 2019

was a record year for such rounds across the globe, except in Europe.

2019 saw 83 mega-rounds totaling $17.2B, a record year in every

market except Europe

Funding of Germany-based startups reached an annual high: 65 deals in 2019 resulted in $1.79 billion raise, compared to

56 deals and raise of $757 million in 2018, and 66 deals and $622 million raise in 2017.

Financial startups in Southeast Asia (SEA) raised

$993 million across 124 rounds in 2019 in what was their best year.

*CB Insights report includes a $666 million financing round of Paytm

It was incorrectly reported by some news outlets and the $666 million raise was part of the $1 billion round the Indian startup had revealed

We have adjusted the data accordingly.