INSUBCONTINENT EXCLUSIVE:

Netflix didn&t add as many subscribers as expected by a bunch of people on Wall Street who, on a quarterly basis,govern whether or not

it&ll be more valuable than Comcast — and that is probably a bad thing, as it one of the primary indicators of its future potential for

said finance folk.

While it still adding subscribers (a lot of them), it fell below the forecasts it set for itself during the second

That shaved off more than $10 billion in its market capitalization this afternoon

This comes amid a spending spree by the company, which is looking to create a ton of original content in order to attract a wider audience

and lock them into that Netflix ecosystem

That could include shows likeGLOW,Jessica Jones,3%or even feature films

But it still a tricky situation because it needs to be able to convert shows from that kind of crazy spend schedule into actual

subscribers.

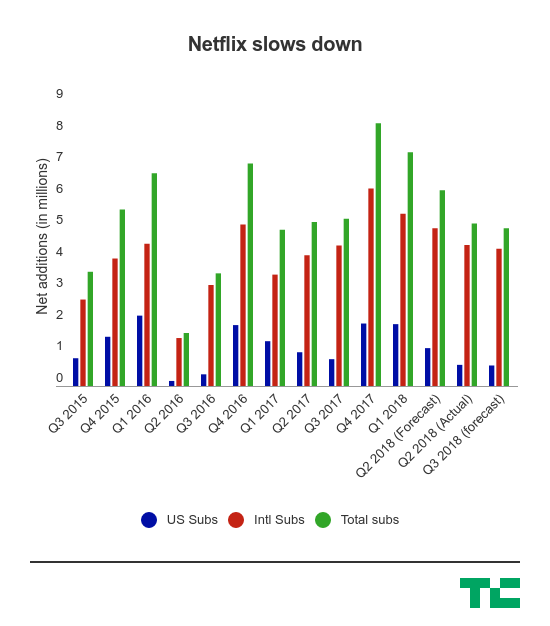

Here the main chart for its subscription growth.:

So it basically down across the board compared to what it set for itself

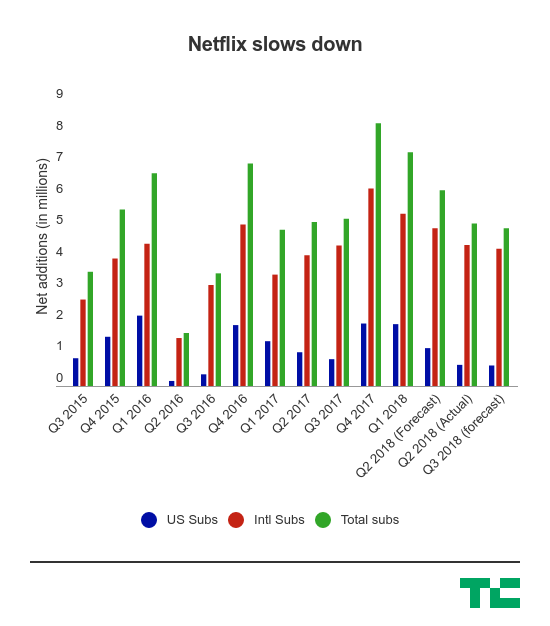

And here thestock chart:

CEOs and executives will normally say they&re focused on delivering long-term value to shareholders, or some

variation of that wording, but Netflix is a company that been on an absolute tear over the course of the past year

It more than doubled in value, overtaking said previously mentioned cable company and signaling that it, too, could be a media consumption

empire that will take a decade to unseat like its predecessor

(Though, to be sure, Comcast is going to bundle in Netflix, so this whole situation is kind of weird.)

Of course, all of this is certainly

not great for the company

The obvious case is that Netflix has to attract a good amount of talent, and that means offering generous compensation packages — which

can include a lot of stock as part of it

But Netflix is also a company that looks to raise a lot of debt to fund the aforementioned spending spree in order to pick up additional

That going to require some assurance that it&ll be a pretty valuable company in the future (and still around, of course), so it may make

those negotiations a little more difficult.

Everything else was pretty much in-line, but in the end, it that subscriber number that didn&t