INSUBCONTINENT EXCLUSIVE:

Twilio today reported a positive quarter that brought it to profitability — on an adjusted basis — ahead of schedule for Wall Street,

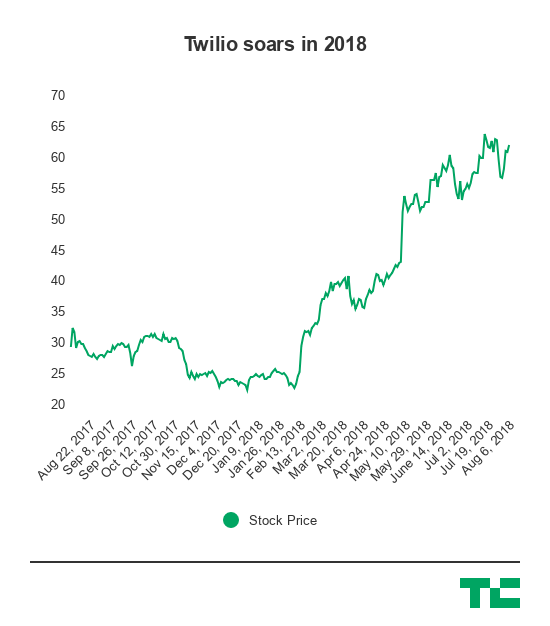

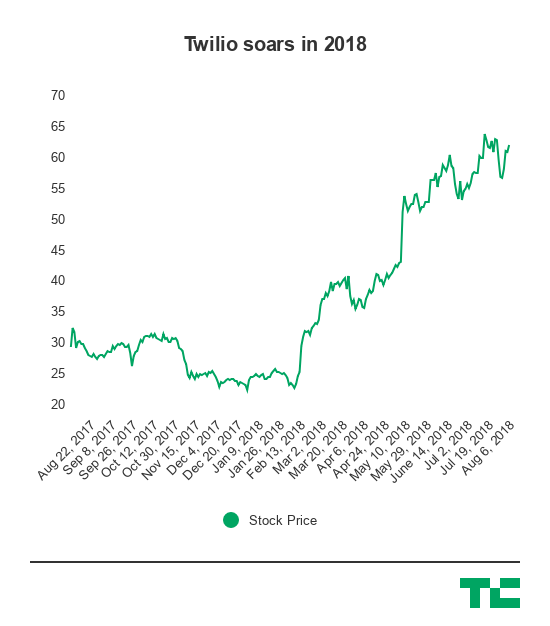

sending the stock soaring 16 percent in extended hours after the release came out.

While according to traditional accounting principles

Twilio still lost money (this usually includes stock-based compensation, a key component of compensation packages), the company is still

showing that it has the capability of being profitable

Born as a go-to tool for startups and larger companies to handle their text- and telephone-related operations, Twilio was among a wave of

IPOs in 2016 that has more or less continued into this year

The company stock has more than doubled in the past year, and is up nearly 170 percent this year alone

Twilio also brought in revenue ahead of Wall Street expectations.

Still, as a services business, Twilio has to show that it can continue

to scale its business while absorbing the cost of the infrastructure required and acquire new customers

It also has to ensure that those customers aren''t leaving, or at least that it bringing on enough new developers more quickly than they are

Larger enterprises, as a result, can be more attractive because they&re more predictable and can lead to bigger buckets of revenue for the

company — and, well, most larger companies still need communications support in some way still today.

On an adjusted basis, Twilio said it

earned 3 cents per share, ahead of the loss of 5 cents that analysts were expecting

It said it brought in $147.8 million in revenue compared to $131.1 million analysts were expecting, so it a beat on both lines, and more

importantly shows that Twilio may be able to morph its toolkit into a mainline business that can end up as the backbone of any company

communication with their customers or users.