INSUBCONTINENT EXCLUSIVE:

Meet Upflow a French startup that wants to help you deal with your outstanding invoices — the company first started at eFounders

If you&re running a small business, chances are you&re either wasting a ton of time or a ton of money on accounts receivable.

Most companies

currently manage invoices using Excel spreadsheets, outdated banking interfaces and unnecessary conversations

Every time somebody signs a deal, they generate an invoice and file it in a spreadsheet somewhere.

Some companies will pay a few days later

Too many companies wait 30 days, 40 days or even more before even thinking about paying past due invoices

You end up sending emails, calling your clients and wasting a ton of time just collecting money

You might even feel bad about asking for money even though you already signed a deal.

In France, most companies use bank transfers to pay

But business banking APIs are not there yet

It means that you have to log in to a slow banking website every day to check if somebody paid you

You can then tick a box in an Excel spreadsheet.

If everything I described resonates with you, Upflow wants to manage your invoices for you

It doesn''t replace your bank account, it doesn''t generate invoices for you

It integrates seamlessly with your existing workflow.

After signing up, you can send invoices to your client and cc Upflow in your email

Upflow then uses optical character recognition and automatically detects relevant data — the customer name, the amount, the due date,

etc.

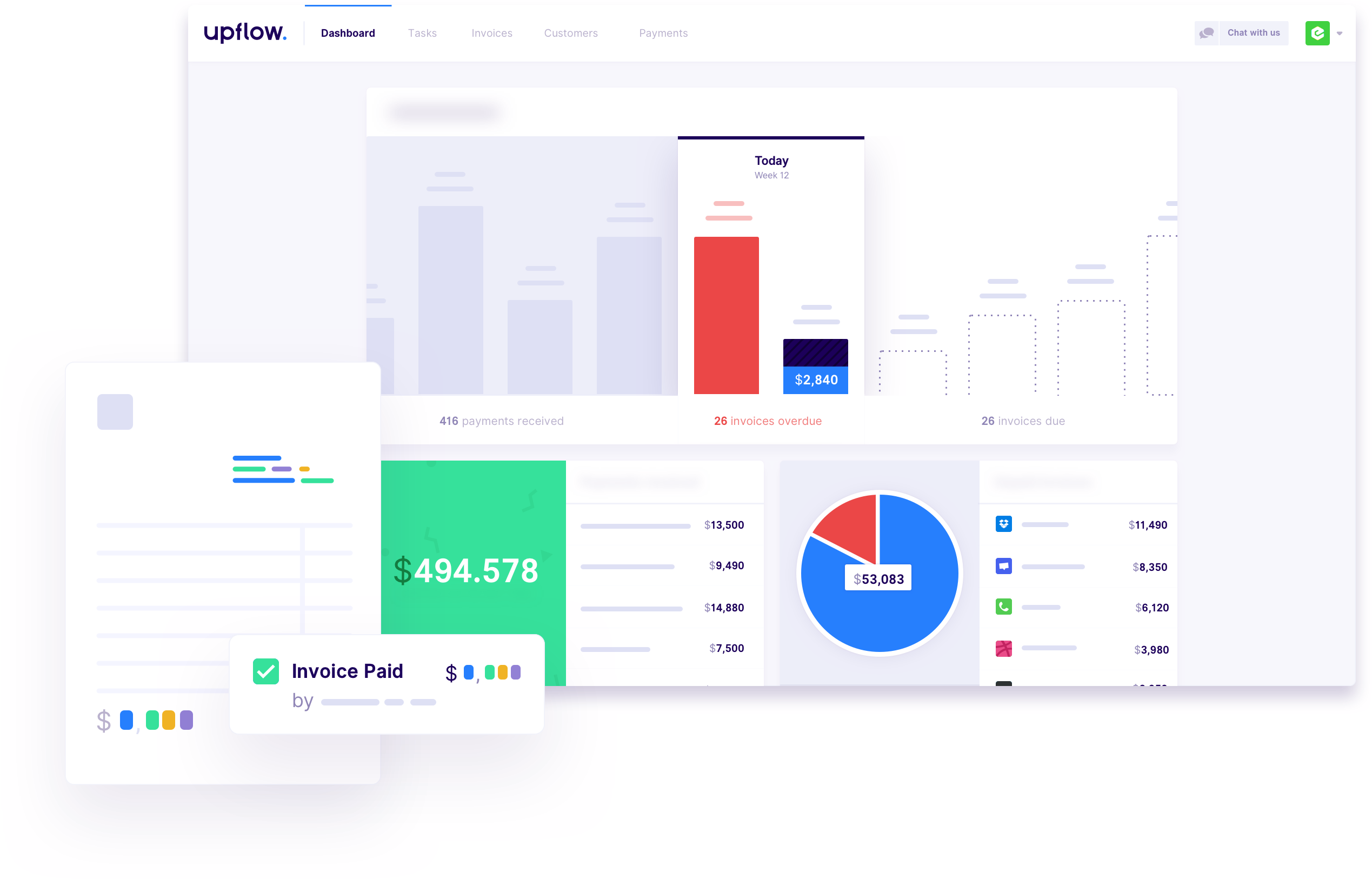

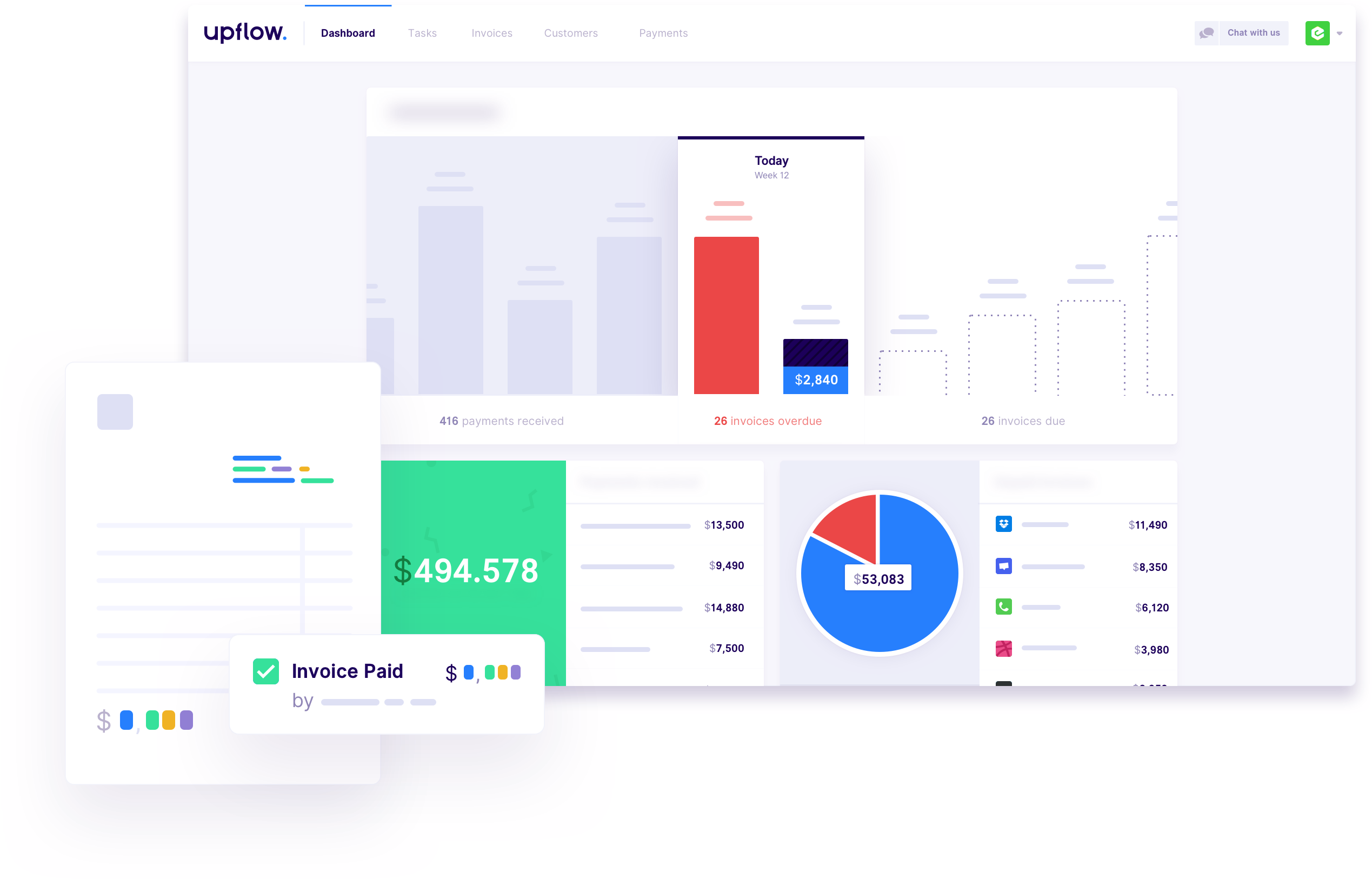

You can view all your outstanding invoices in Upflow interface to see where you stand

The service gives you a list of actionable tasks to get your money

For instance, Upflow tells you if you have overdue payments and tells you to contact your client again.

You can set up different rules

depending on your clients

For instance, if you have many small clients, you can automate some of those messages

But if you only work with a handful of clients, you want to make sure that somebody has manually reviewed each message before Upflow sends

them.

By default, you write your emails in Upflow so that your other team members can see what happened

You can browse invoices by client to see if somebody has multiple unpaid invoices

Upflow lets you assign actions to a particular team member if they&re more familiar with this specific client.

But all of this is just one

Upflow also generates banking information with the help of Treezor

This way, you can put your Upflow banking information on your invoices.

When a customer pays you, Upflow automatically matches invoices with

This feature alone lets you save a ton of time

The startup transfers money back to your company bank account every day.

Upflow co-founder and CEO Alexandre Louisy drew me the following

It probably easier to understand after reading my explanations:

In other words, Upflow has created a brick that sits between your company

back office and your customers

Eventually, you could imagine more services built on top of this brick as Upflow is learning many things on your company.

According to

Louisy, small and medium companies really need this kind of product — and not necessarily tech companies

Those companies don''t have a lot of money on their bank accounts, don''t have a big staff and need to save as much time as possible.

Now

let see if it easy to sell a software-as-a-service solution to a family business that has been around for decades.