Music

Trailers

DailyVideos

India

Pakistan

Afghanistan

Bangladesh

Srilanka

Nepal

Thailand

StockMarket

Business

Technology

Startup

Trending Videos

Coupons

Football

Search

Download App in Playstore

Download App

Best Collections

Technology

Tesla has reportedly secured more than $1.4 billion in financing in the form of loans from multiple Chinese banks in order to help fund the construction of its new gigafactory in Shanghai. First Reuters and now Bloomberg reported the funding as confirmed on Monday morning, with an official announcement to happen sometime this week.

The loan will be distributed across five years, and will be used to both set up the new gigafactory and to help finance Teslaestablishing of its China-based operations.

Tesla announced plans to construct its Shanghai gigafactory in July 2018, after which it opened pre-orders for its Model 3 vehicle in the country. The automaker is expected to be able to offer Model 3 cars built in-country at a slightly lower price than imported models. This factory will focus on supplying Model 3 vehicles specifically for the Chinese Market, and Tesla already broke ground on the Shanghai-based facility in Januaryand began producing some vehicles, but as with its other gigafactories, the company can bring parts of the plant online while it works on completing other parts of the gigantic manufacturing plant.

Including the European gigafactory outside of Berlin that Tesla CEO Elon Musk announced in November, the automaker now has four gigafactories either operating, under construction or in development, including one in Reno, Nev., and one in Buffalo, N.Y. Musk has teased a potential fith gigafactory location reveal, but the company hasn&t provided any specifics thus far.

- Details

- Category: Technology

Read more: Tesla lands $1.4 billion from Chinese banks to build out its Shanghai gigafactory

Write comment (97 Comments)

HomeLane, a Bangalore-based startup that helps people manage home renovations and interior design, today announced it has raised $30 million in a new financing round as it looks to expand its proprietary technology.

The financing round, dubbed Series D, was led by Evolvence India Fund (EIF), Pidilite Group and FJ Labs. Existing investors Accel Partners, Sequoia Capital and JSW Ventures also participated in the round, which pushes the five-year-old startupall-time raise to $46 million.

HomeLane helps property owners furnish and install fixtures in their new apartments and houses. Interior designers need to be local to customers and supply chain partners need to have the capacity to ship to a location. So HomeLane has established 16 experience centers in seven Indian cities so consumers can touch and see materials and furniture.

The startup plans to use the fresh capital to broaden its technology infrastructure and expand to eight to 10 additional cities.

HomeLane competes with other online furniture sellers such as Livspace and Urban Ladder, as well as brick-and-mortar stores. Founders Rama Harinath and Srikanth Iyer say their startup differentiates by offering a one-stop shop — it sells everything from fitted kitchens and wardrobes to entertainment units and shoe racks — and by providing guaranteed on-time delivery and after-sale services to help homeowners finish projects.

The site allows property owners to upload floor plans, which are reviewed by interior designers who provide product suggestions, price quotes and 3D pictures of how furnishings and fixtures will look after they are installed. The startup, which has worked with more than 900 design experts to deliver over 6,000 projects, pays to the designers a fraction of the money it charges customers.

Iyer, who serves as the chief executive of HomeLane, claimed that the startup is inching closer to being EBIDTA profitable (which does not include taxes and a range of other expenses). That would be a notable turnaround for HomeLane, which reported a net loss of $4.1 million on revenue of $5.6 million in the financial year that ended in March 2018.

Prashanth Prakash, a partner at Accel India, said, &We are very happy with HomeLanecurrent growth trajectory and are believers in the long-term growth prospects of the home improvement consumer segment in India.&

- Details

- Category: Technology

Read more: India’s HomeLane raises $30M to expand its one-stop shop for interior design

Write comment (90 Comments)So what happens when fintech ‘brings it all together&? In a world where people access their financial services through one universal hub, which companies are the best-positioned to win? When open data and protocols become the norm, what business models are set to capitalize on the resulting rush of innovation, and which will become the key back-end and front-end products underpinning finance in the 2020s?

Ithard to make forward-looking predictions that weather a decade well when talking about the fortunes of individual companies. Still, even if these companies run into operating headwinds, the rationale for their success will be a theme we see play out over the next ten years.

Here are five companies positioned to win the 2020s in fintech:

1. Plaid

In 2014, I met Zach Perret and Carl Tremblay when they reached out to pitch Funding Circle on using Plaid to underwrite small and medium businesses with banking data. At the time, I couldn&t understand how a bank account API was a valuable business.

PlaidSeries C round in 2018 came with a valuation of $2.65 billion, which caught a lot of people in fintech off-guard. The company, which had been modestly building financial services APIs since 2012, recently crossed the threshold of 10 billion transactions processed since inception.

For those unfamiliar with Plaidbusiness model, it operates as the data exchange and API layer that ties financial products together. If you&ve ever paid someone on Venmo or opened a Coinbase account, chances are you linked your bank account through Plaid. Itpossible in 2020 to build a range of powerful financial products because fintechs can pull in robust data through aggregator services like Plaid, so a bet on the fintech industry is, in a sense, a derivative bet on Plaid.

Those 10 billion transactions, meanwhile, have helped Plaid understand the people on its& clients fintech platforms. This gives it the data to build more value-added services on top of its transactions conduit, such as identity verification, underwriting, brokerage, digital wallets… the company has also grown at a breakneck pace, announcing recent expansions into the UK, France, Spain, and Ireland.

As banks, entrepreneurs, and everyone in-between build more tailored financial products on top of open data, those products will operate on top of secure, high-fidelity aggregators like Plaid.

The biggest unknown for aggregators like Plaid is whether any county debuts a universal, open-source financial services API that puts pricing pressure on a private version. However, this looks like a vanishingly remote possibility given high consumer standards for data security and Plaidvalue-added services.

2. Stripe

Predicting Stripe success is the equivalent of ‘buying high,& but it is hard to argue against Stripepole position over the next fintech decade. Stripe is a global payments processor that creates infrastructure for online financial transactions. What that means is: Stripe enables anyone to accept and make payments online. The payment protocol is so efficient that itwon over the purchase processing business of companies like Target, Shopify, Salesforce, Lyft, and Oxfam.

Processing the worldpayments is a lucrative business, and one that benefits from the joint tailwinds of the growth of ecommerce and the growth of card networks like Visa and Mastercard. As long as more companies look to accept payment for services in some digital form, whether online or by phone, Stripe is well-positioned to be the intermediary.

The companysuccess has allowed Stripe to branch into other services like Stripe Capital to lend directly to ecommerce companies based off their cashflow, or the Stripe Atlas turnkey tool for forming a new business entirely. Similar to Plaid, Stripe has a data network effects business, which means that as it collects more data by virtue of its transaction-processing business, it can leverage this core competency to launch more products associated with that data.

The biggest unknown for Stripeprospects is whether open-source payment processing technology gets developed in a way that puts price pressure on Stripemargins. Proponents of crypto as a medium of exchange predict that decentralized currencies could have such low costs that vendors are incentivized to switch to them to save on the fees of payment networks. However, in such an event Stripe could easily be a mercenary, and convert its processing business into a free product that underpins many other more lucrative services layered on-top (similar to the free trading transition brought about by Robinhood).

- Details

- Category: Technology

Read more: Who will the winners be in the future of fintech

Write comment (93 Comments)The birth and growth of financial technology developed mostly over the last ten years.

So as we look ahead, what does the next decade have in store? I believe we&re starting to see early signs: in the next ten years, fintech will become portable and ubiquitous as it moves to the background and centralizes into one place where our money is managed for us.

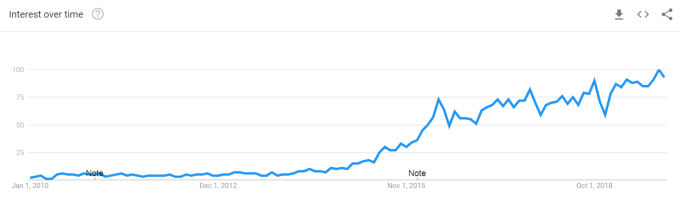

When I started working in fintech in 2012, I had trouble tracking competitive search terms because no one knew what our sector was called. The best-known companies in the space were Paypal and Mint.

Google search volume for &fintech,& 2000 & present.

Fintech has since become a household name, a shift that came with with prodigious growth in investment: from $2 billion in 2010 to over $50 billion in venture capital in 2018 (and on-pace for $30 billion+ this year).

Predictions were made along the way with mixed results — banks will go out of business, banks will catch back up. Big tech will get into consumer finance. Narrow service providers will unbundle all of consumer finance. Banks and big fintechs will gobble up startups and consolidate the sector. Startups will each become their own banks. The fintech ‘bubble& will burst.

Herewhat did happen: fintechs were (and still are) heavily verticalized, recreating the offline branches of financial services by bringing them online and introducing efficiencies. The next decade will look very different. Early signs are beginning to emerge from overlooked areas which suggest that financial services in the next decade will:

- Be portable and interoperable:Like mobile phones, customers will be able to easily transition between ‘carriers&.

- Become more ubiquitous and accessible:Basic financial products will become a commodity and bring unbanked participants ‘online&.

- Move to the background:The users of financial tools won&t have to develop 1:1 relationships with the providers of those tools.

- Centralize into a few places and steer on ‘autopilot&.

Prediction 1: The open data layer

Thesis: Data will be openly portable and will no longer be a competitive moat for fintechs.

Personal data has never had a moment in the spotlight quite like 2019. The Cambridge Analytica scandal and the data breach that compromised 145 million Equifax accounts sparked todaypublic consciousness around the importance of data security. Last month, the House of Representatives& Fintech Task Force met to evaluate financial data standards and the Senate introduced the Consumer Online Privacy Rights Act.

A tired cliché in tech today is that &data is the new oil.& Other things being equal, one would expect banks to exploit their data-rich advantage to build the best fintech. But while itnecessary, data alone is not a sufficient competitive moat: great tech companies must interpret, understand and build customer-centric products that leverage their data.

Why will this change in the next decade? Because the walls around siloed customer data in financial services are coming down. This is opening the playing field for upstart fintech innovators to compete with billion-dollar banks, and ithappening today.

Much of this is thanks to a relatively obscure piece of legislation in Europe, PSD2. Think of it as GDPR for payment data. The UK became the first to implement PSD2 policy under its Open Banking regime in 2018. The policy requires all large banks to make consumer data available to any fintech which the consumer permissions. So if I keep my savings with Bank A but want to leverage them to underwrite a mortgage with Fintech B, as a consumer I can now leverage my own data to access more products.

Consortia like FDATA are radically changing attitudes towards open banking and gaining global support. In the U.S., five federal financial regulators recently came together with a rare joint statement on the benefits of alternative data, for the most part only accessible through open banking technology.

The data layer, when it becomes open and ubiquitous, will erode the competitive advantage of data-rich financial institutions. This will democratize the bottom of the fintech stack and open the competition to whoever can build the best products on top of that openly accessible data… but building the best products is still no trivial feat, which is why Prediction 2 is so important:

Prediction 2: The open protocol layer

Thesis: Basic financial services will become simple open-source protocols, lowering the barrier for any company to offer financial products to its customers.

Picture any investment, wealth management, trading, merchant banking, or lending system. Just to get to market, these systems have to rigorously test their core functionality to avoid legal and regulatory risk. Then, they have to eliminate edge cases, build a compliance infrastructure, contract with third-party vendors to provide much of the underlying functionality (think: Fintech Toolkit) and make these systems all work together.

The end result is that every financial services provider builds similar systems, replicated over and over and siloed by company. Or even worse, they build on legacy core banking providers, with monolith systems in outdated languages (hello, COBOL). These services don&t interoperate, and each bank and fintech is forced to become its own expert at building financial protocols ancillary to its core service.

But three trends point to how that is changing today:

First, the infrastructure and service layer to build is being disaggregates, thanks to platforms like Stripe, Marqeta, Apex, and Plaid. These ‘finance as a service& providers make it easy to build out basic financial functionality. Infrastructure is currently a hot investment category and will be as long as more companies get into financial services — and as long as infra market leaders can maintain price control and avoid commoditization.

Second, industry groups like FINOS are spearheading the push for open-source financial solutions. Consider a Github repository for all the basic functionality that underlies fintech tools. Developers could continuously improve the underlying code. Software could become standardized across the industry. Solutions offered by different service providers could become more inter-operable if they shared their underlying infrastructure.

And third, banks and investment managers, realizing the value in their own technology, are today starting to license that technology out. Examples are BlackRock Aladdin risk-management system or GoldmanAlloy data modeling program. By giving away or selling these programs to clients, banks open up another revenue stream, make it easy for the financial services industry to work together (think of it as standardizing the language they all use), and open up a customer base that will provide helpful feedback, catch bugs, and request new useful product features.

As Andreessen Horowitz partner Angela Strange notes, &what that means is, there are several different infrastructure companies that will partner with banks and package up the licensing process and some regulatory work, and all the different payment-type networks that you need. So if you want to start a financial company, instead of spending two years and millions of dollars in forming tons of partnerships, you can get all of that as a service and get going.&

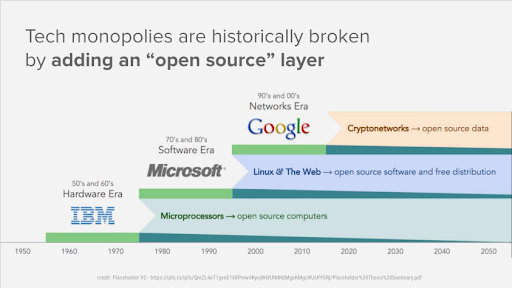

Fintech is developing in much the same way computers did: at first software and hardware came bundled, then hardware became below differentiated operating systems with ecosystem lock-in, then the internet broke open software with software-as-a-service. In that way, fintech in the next ten years will resemble the internet of the last twenty.

Infographic courtesy Placeholder VC

Prediction 3: Embedded fintech

Thesis: Fintech will become part of the basic functionality of non-finance products.

The concept of embedded fintech is that financial services, rather than being offered as a standalone product, will become part of the native user interface of other products, becoming embedded.

This prediction has gained supporters over the last few months, and iteasy to see why. Bank partnerships and infrastructure software providers have inspired companies whose core competencies are not consumer finance to say &why not?& and dip their toes in fintechwaters.

Apple debuted the Apple Card. Amazon offers its Amazon Pay and Amazon Cash products. Facebook unveiled its Libra project and, shortly afterward, launched Facebook Pay. As companies from Shopify to Target look to own their payment and purchase finance stacks, fintech will begin eating the world.

If these signals are indicative, financial services in the next decade will be a feature of the platforms with which consumers already have a direct relationship, rather than a product for which consumers need to develop a relationship with a new provider to gain access.

Matt Harris of Bain Capital Ventures summarizes in a recent set of essays (one, two) what it means for fintech to become embedded. His argument is that financial services will be the next layer of the ‘stack& to build on top of internet, cloud, and mobile. We now have powerful tools that are constantly connected and immediately available to us through this stack, and embedded services like payments, transactions, and credit will allow us to unlock more value in them without managing our finances separately.

Fintech futurist Brett King puts it even more succinctly: technology companies and large consumer brands will become gatekeepers for financial products, which themselves will move to the background of the user experiences. Many of these companies have valuable data from providing sticky, high-affinity consumer products in other domains. That data can give them a proprietary advantage in cost-cutting or underwriting (eg: payment plans for new iPhones). The combination of first-order services (eg: making iPhones) with second-order embedded finance (eg: microloans) means that they can run either one as a loss-leader to subsidize the other, such as lowering the price of iPhones while increasing Appletake on transactions in the app store.

This is exciting for the consumers of fintech, who will no longer have to search for new ways to pay, invest, save, and spend. It will be a shift for any direct-to-consumer brands, who will be forced to compete on non-brand dimensions and could lose their customer relationships to aggregators.

Even so, legacy fintechs stand to gain from leveraging the audience of big tech companies to expand their reach and building off the contextual data of big tech platforms. Think of Uber rides hailed from within Google Maps: Uber made a calculated choice to list its supply on an aggregator in order to reach more customers right when they&re looking for directions.

Prediction 4: Bringing it all together

Thesis: Consumers will access financial services from one central hub.

In-line with the migration from front-end consumer brand to back-end financial plumbing, most financial services will centralize into hubs to be viewed all in one place.

For a consumer, the hub could be a smartphone. For a small business, within Quickbooks or Gmail or the cash register.

As companies like Facebook, Apple, and Amazon split their operating systems across platforms (think: Alexa + Amazon Prime + Amazon Credit Card), benefits will accrue to users who are fully committed to one ecosystem so that they can manage their finances through any platform — but these providers will make their platforms interoperable as well so that Alexa (e.g.) can still win over Android users.

As a fintech nerd, I love playing around with different financial products. But most people are not fintech nerds and prefer to interact with as few services as possible. Having to interface with multiple fintechs separately is ultimately value subtractive, not additive. And good products are designed around customer-centric intuition. In her piece, Google Maps for Money, Strange calls this ‘autonomous finance:& your financial service products should know your own financial position better than you do so that they can make the best choices with your money and execute them in the background so you don&t have to.

And so now we see the rebundling of services. But are these the natural endpoints for fintech? As consumers become more accustomed to financial services as a natural feature of other products, they will probably interact more and more with services in the hubs from which they manage their lives. Tech companies have the natural advantage in designing the product UIs we love — do you enjoy spending more time on your bankwebsite or your Instagram feed? Today, these hubs are smartphones and laptops. In the future, could they be others, like emails, cars, phones or search engines?

As the development of fintech mirrors the evolution of computers and the internet, becoming interoperable and embedded in everyday services, it will radically reshape where we manage our finances and how little we think about them anymore. One thing is certain: by the time I&m writing this article in 2029, fintech will look very little like it did today.

So which financial technology companies will be the ones to watch over the next decade? Building off these trends, we&ve picked five that will thrive in this changing environment.

- Details

- Category: Technology

Read more: Fintech’s next decade will look radically different

Write comment (93 Comments)

The WD 5TB Elements and the Seagate 5TB Expansion are the cheapest portable hard drives per terabyte right now; they both cost $99.99 for an unformatted capacity of 5TB, which equates to just under $20 per TB.

You won’t find anything cheaper anywhere although we can see that prices have been down to as little as $89.99 recently.

Both utilise

- Details

- Category: Technology

Read more: This is the cheapest portable hard drive per terabyte right now

Write comment (95 Comments)

Apple and Google have both taken down messaging services ToTok from their app stores following accusations of government surveillance.

According to the New York Times, the messaging app has been accused of being a spying tool for the United Arab Emirates government.

Although only a few months old, ToTok has seen a huge rise of popularity, with

- Details

- Category: Technology

Read more: Delete ToTok, it could be spying on you, users told

Write comment (96 Comments)Page 59 of 5614

12

12