Imagine Marketing, the company that owns wearable brand Boat, has become the latest domestic technology (tech) company to shelve its listing plans.

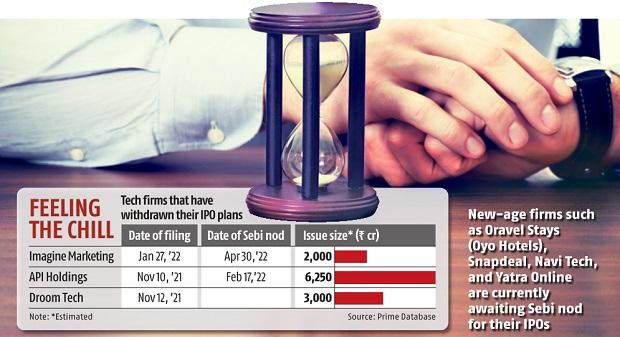

The popular consumer tech brand joins the PharmEasy parent API Holdings, and online automobile marketplace Droom Technology, to withdraw its draft red herring prospectus (DRHPs).

Industry players dont rule out more tech firms following suit.

A drop in valuations of listed tech firms, increased regulatory scrutiny and poor investor response during roadshows are seen as reasons for suspension of listing plans by tech companies.Sebi has increased scrutiny, particularly in relation to valuations, and has also introduced various disclosure requirements requiring companies to provide explanations about change in valuation between the pre-IPO placements and the issue price in an IPO.

This has compelled new-age tech companies to reconsider their valuations, strategies, and also the timing of going public.

Additionally, it seems that certain companies are also experiencing poor demand in the bid process and roadshows.

This has also led to the postponement or withdrawal of some listings, said Gaurav Mistry, Partner, DSK Legal.Boat had filed its DRHP with the Securities and Exchange Board of India (Sebi) in January and obtained a go-ahead in April.

The company was looking to raise Rs 900 crore in fresh capital through the IPO.

On Friday, it announced it has raised Rs 500 crore from an affiliate of Warburg Pincus, and Malabar Investments.Companies that are unable to launch their IPOs are instead raising capital from private equity (PE) investors.

Financial conditions are currently choppy and we thought that it would be prudent to wait to do an IPO, said Vivek Gambhir, chief executive officer (CEO), Boat.In August, PharmEasy decided to shelve its Rs 6,250-crore IPO and instead raise money from existing investors via rights issue.

The online pharmacy had filed its DRHP in November 2021 and obtained Sebi approval in February.

Droom, which had filed for a Rs 3,000-crore IPO in November 2021, pulled out its IPO earlier this month.

Sources said the company was targeting a valuation in excess of Rs 15,000 crore and didnt find enough takers amid the meltdown in prices of listed tech firms.Shares of Zomato, Paytm, Nykaa and Policy Bazaar are down between 50 and 75 per cent from their highs, forcing companies waiting on the sidelines to rethink their valuations.I believe that this is a reflection of the current market environment where tech companies are seeing their valuations soften, particularly in public markets, as a result of tightened capital flows due to geo-political tensions, and fears of a recession looming over some of the world economies, said Murtaza Zoomkawala, partner, Saraf - Partners.New-age firms such as Oravel Stays (Oyo Hotels), Snapdeal and Yatra Online are currently awaiting Sebi nod for their IPOs.

Sources said that the sharp erosion in investor wealth has prompted the regulator to take a cautious approach towards approving the IPOs of loss-making companies.

Last month, the Sebi board approved changes to the IPO framework requiring companies to justify pricing through disclosure of key performance indicators (KPIs), and by referencing it to the most recent capital raise.While this may make the already onerous IPO disclosure more cumbersome, it may not necessarily be a deterrent to new-age tech companies from floating their IPOs in India, should a market for their stock be available, said Zoomkawala.

17

17