Amazon.com Inc.

is looking to sell investment-grade bonds for general corporate purposes, its second offering this year in the dollar market.The online retail giant is issuing senior unsecured bonds in as many as five parts.

The longest portion of the offering, a 10-year security, may yield 1.15 percentage points over Treasuries, according to a person with knowledge of the matter, who asked not to be identified as the details are private.The target size of the offering is $7 billion, but that could change, the person said.Proceeds may be used to repay debt as well as funding acquisitions and share buybacks, the person added.

Amazon last sold bonds in April, raising $12.75 billion, which was the companys first offering in about a year at the time.Amazon is among 10 companies looking to sell debt on Tuesday ahead of anticipated volatility over the next few days.

Federal Reserve chairman Jerome Powell is scheduled to speak Wednesday, with key inflation data to follow Thursday and the employment report on Friday, making Tuesdays session likely the last wide open window this week.Read more: Amazon to Lead 10-Issuer Blitz in US High-Grade Primary MarketThe sale also comes as credit fundamentals create an optimistic backdrop for issuing debt.

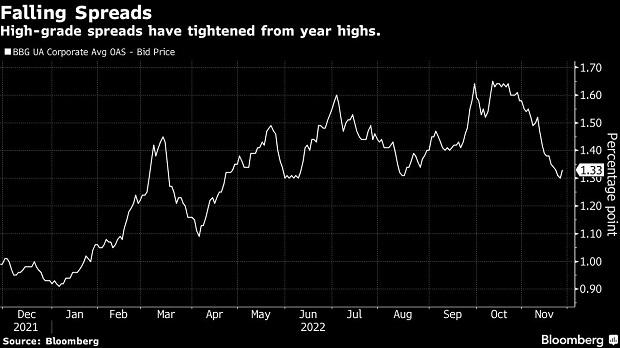

Investment-grade credit spreads are currently at 133 basis points, more than 30 basis points away from the years peak at 165.

The cost of issuing debt has also fallen since reaching a high in October, now sitting at 5.36%.Amazons total debt load now exceeds $70 billion, according to Bloomberg Intelligence analyst Robert Schiffman, but that doesnt keep the company from remaining at the top of its sector.Its five-tranche bond offering, with initial price talk ranging from 45-115 bps over Treasuries for maturities ranging from 2-10 years, is tight to peers for good reasons, we believe, including the companys dominant cloud and retail businesses, $59 billion of cash and potential for its credit profile (A1/AA/AA-) to continue to improve, Schiffman wrote in a note Tuesday.

With that amount of cash, funding isnt needed, but it enhances duration and provides incremental firepower for potential additional M-A and larger share buybacks.

13

13