Music

Trailers

DailyVideos

India

Pakistan

Afghanistan

Bangladesh

Srilanka

Nepal

Thailand

StockMarket

Business

Technology

Startup

Trending Videos

Coupons

Football

Search

Download App in Playstore

Download App

Best Collections

Technology

- Details

- Category: Technology Today

Read more: Woman catches husband cheating as Amazon Alexa secretly records sex sessions

Write comment (90 Comments)

To read this article in full, please click here

- Details

- Category: Technology Today

Read more: GoDaddy Websites + Marketing is perfect for new brands looking to get online.

Write comment (99 Comments)

I don't know about you, but I spend a shockingly high amount of my life staring at the Google Docs interface.

Docs is where I write all of my columns and articles along with other assorted musings. And by and large, it's an ideal environment for me to transfer thoughts from my noggin onto the screen: It's fully featured enough to do everything I want and yet simple enough to be easy to use. And, of course, all of my work is constantly saved, instantly available on my phone (or any other device I happen to be using), and automatically connected to the rest of the Google ecosystem in some pretty helpful ways.

Still, I can't help but feel the occasional tinge of envy when I see people talking about their super-minimalist, distraction-free writing apps — those canvas-like surfaces for scribbling words in a serene setting, with an eye-pleasing color scheme and no on-screen commands to steal away focus. Whenever I see one of those interfaces and then go back to Docs, I'm suddenly all too aware of the fact that I'm working in an overly sterile word processor instead of the spa-like oasis of a writing app.

To read this article in full, please click here

- Details

- Category: Technology Today

Read more: Give Google Docs a distraction-free upgrade

Write comment (98 Comments)

Once upon a time, the Internet was amazing, enabling niche interests and connecting people. AppleiMac was the epitome of the era, while the iPhone became the prophet of change.

Now, the home is the next connected frontier, and one that should be as secure & as much as possible & as the office. That's especially true given recent trends toward more remote work from home, where corporate data can be endangered by weak security.

What is HomeKit-secured and why should you use it?

These days hackers break into home networks using our routers and smart home devices, which is why everyone must learn how to use HomeKit-secured routers to keep their connected homes safe.

To read this article in full, please click here

- Details

- Category: Technology Today

Read more: How and why you need HomeKit-secured smart homes

Write comment (94 Comments)

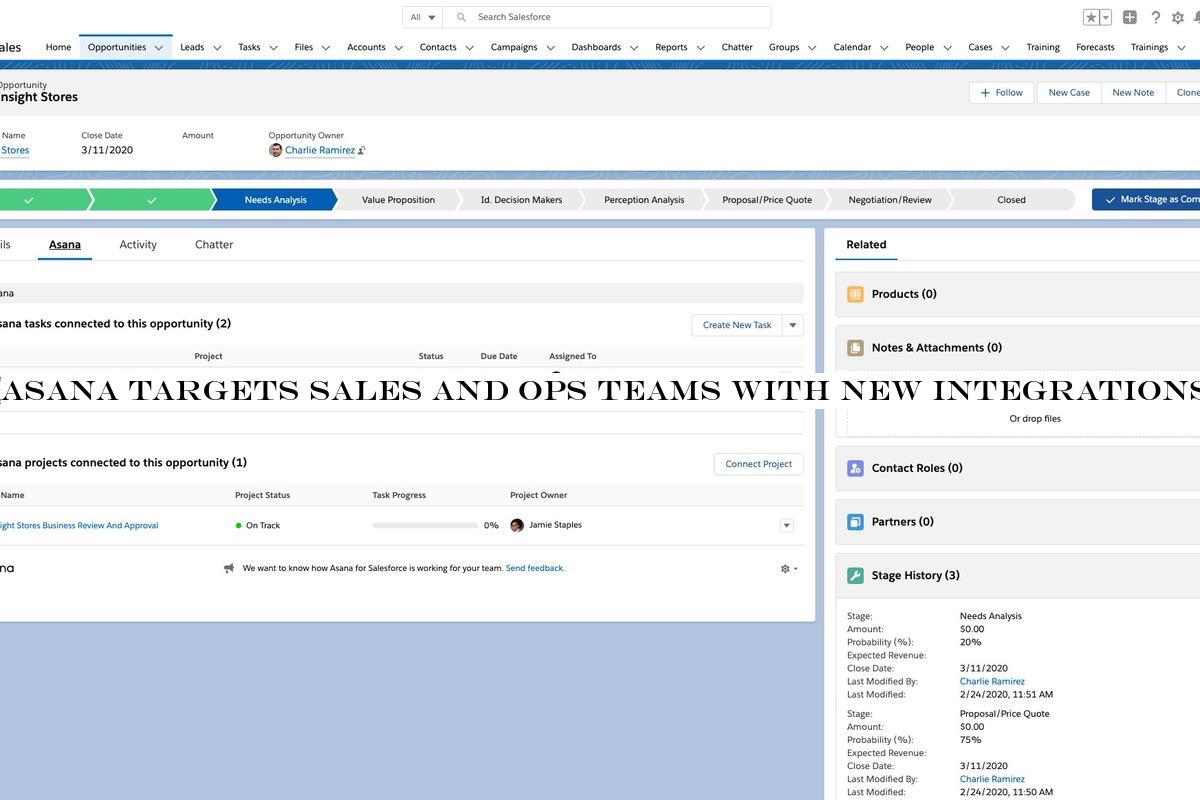

Asana has tailored its app to be more useful to sales and operations workers with workflow templates and new third-party application integrations, including Salesforce and Jira Cloud.

The work management software vendor launched its first offering aimed at a specific job role last year with Asana for Marketing. The list of options for individual business units grew today with the addition of Asana Operations and Asana Sales.

Asana for Operations lets users access Asanagallery of workflow templates or create their own custom versions to standardize processes such as vendor and employee onboarding and management.

To read this article in full, please click here

- Details

- Category: Technology Today

Read more: Asana targets sales and ops teams with new integrations

Write comment (92 Comments)

When you think about your smartphone, apps and interfaces are probably the first things that come to mind. Beneath all that surface-level stuff, though, our modern mobile devices are filled with files — folders upon folders of 'em! — just like the clunky ol' computers we've relied upon for ages.

We may not come face to face with our phones' file systems too often, but it's valuable to know they're there — and to know how they can work for us when the need arises. After all, your Android device is a productivity powerhouse. It can juggle everything from PDFs and PSDs to presentations and podcasts. It can even act as a portable hard drive and house any sort of important files you might need in your pocket (and not just on some far-away cloud). Your mobile device can carry an awful lot of data, and there may come a time when you want to dig in and deal directly with it.

To read this article in full, please click here

- Details

- Category: Technology Today

Read more: Android file management: An easy-to-follow guide

Write comment (90 Comments)Page 1343 of 1414

17

17