Music

Trailers

DailyVideos

India

Pakistan

Afghanistan

Bangladesh

Srilanka

Nepal

Thailand

StockMarket

Business

Technology

Startup

Trending Videos

Coupons

Football

Search

Download App in Playstore

Download App

Best Collections

Technology

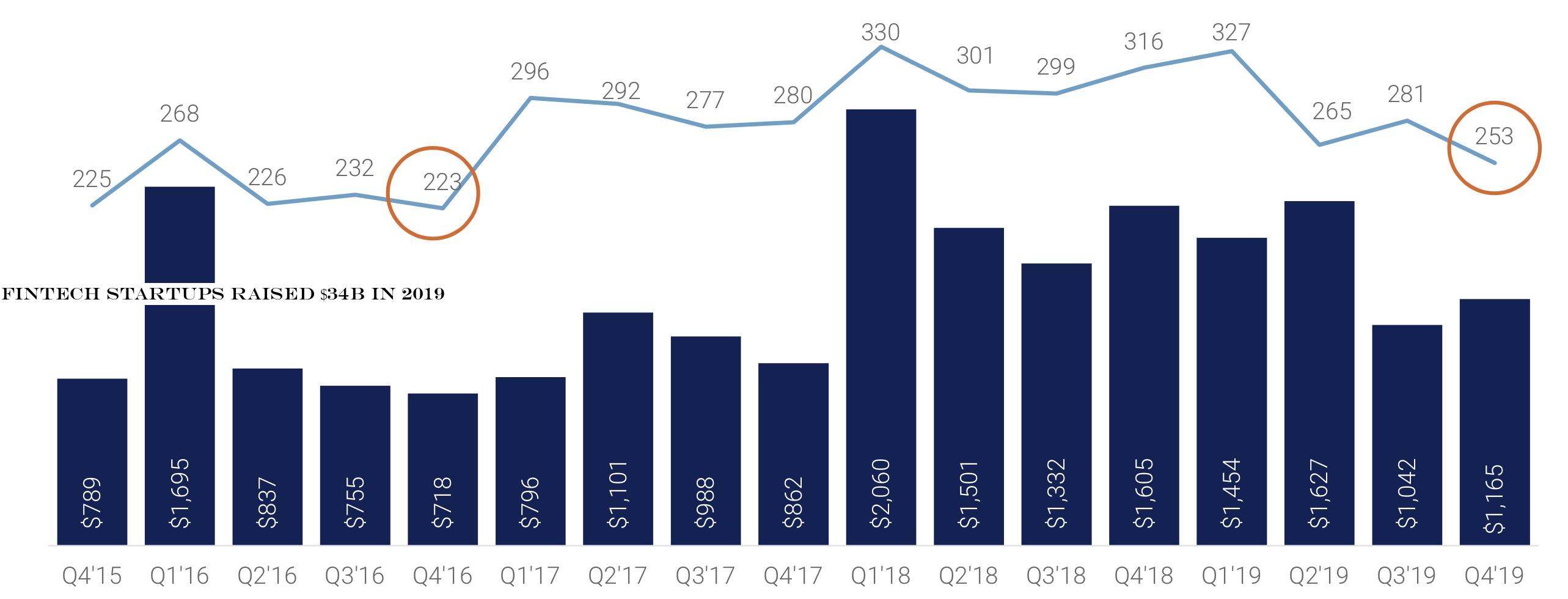

Financial services startups raised less money in 2019 than they did in 2018 as VC firms looked to back late stage firms and focused on developing markets, a new report has revealed.

According to research firm CB Insights& annual report published this week, fintech startups across the world raised $33.9 billion* in total last year across 1,912 deals*, down from $40.8 billion they picked up by participating in 2,049 deals the year before.

Ita comprehensive report, which we recommend you read in full here (your email is required to access it), but below are some of the key takeaways.

- Early stage startups struggled to attract money: Per the report, financing for startups looking to close Seed or Series A dropped to a five-year low in 2019. On the flip side, money pouring into Series B or beyond startups was at record five-year high.

Early-stage deals dropped to a 12-quarter low as deal share globally shifts to mid- and late-stages (CB Insights)

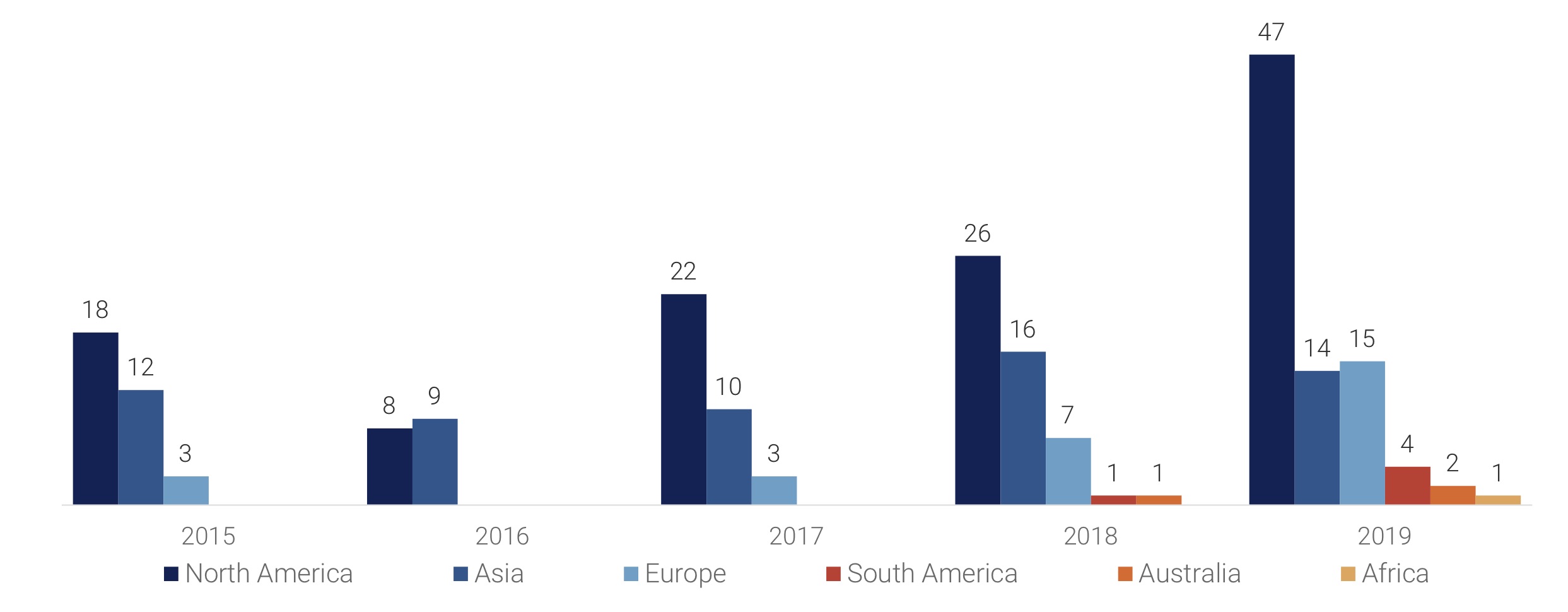

- Emerging and frontier markets were at the centre stage of the most of the action: South America, Africa, Australia, and Southeast Asia all topped their annual highs last year.

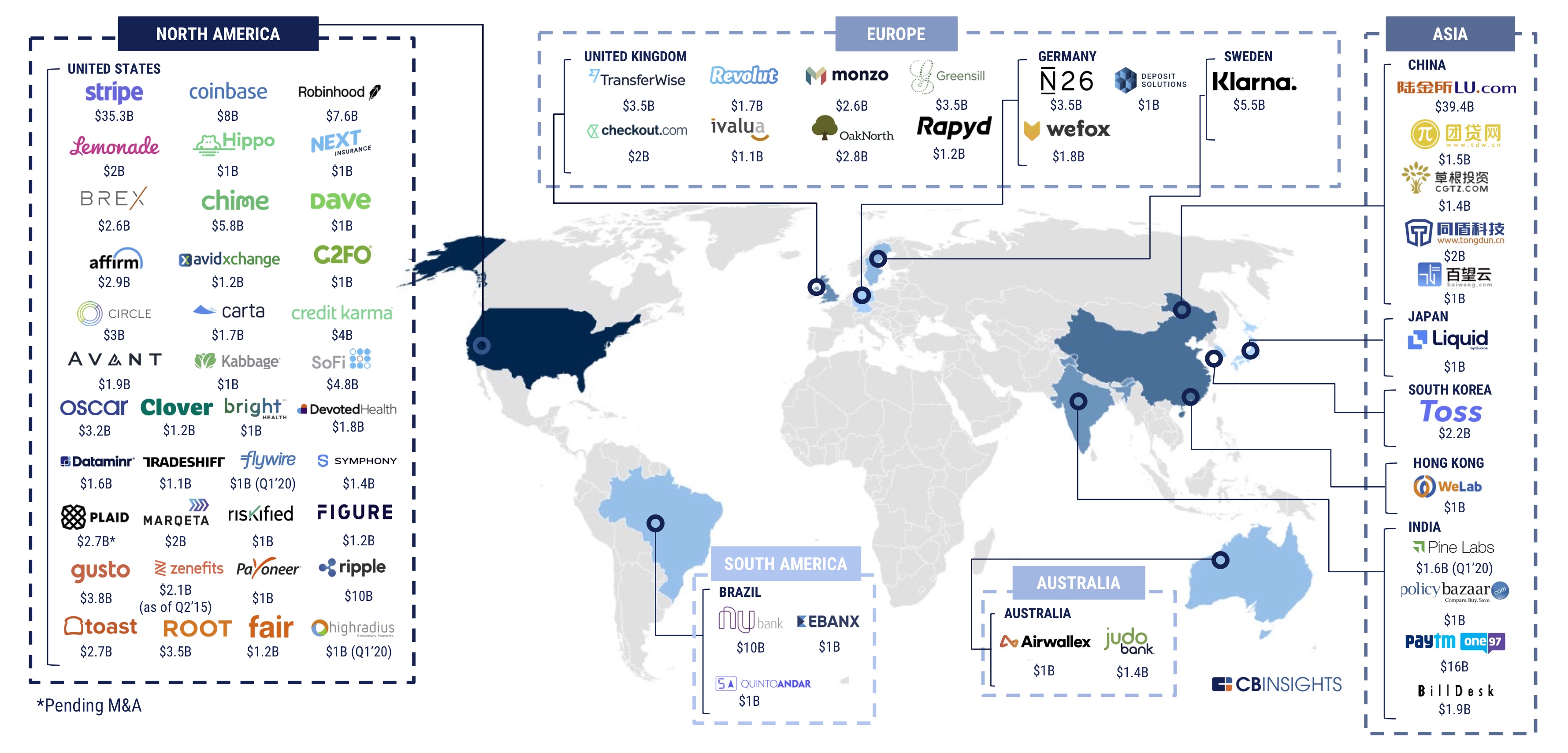

- Asia outpaced Europe in the second half of last year on both number of deals and bulk of capital raised. In Q3, European startups raised $1.6 billion through 95 deals, compared to $1.8 billion amassed by Asian startups across 157 deals. In Q4, a similar story was at play: European startups participated in 100 rounds to raise $1.2 billion, compared to $2.14 billion* raised by Asian startups across 125 deals*.

- Emergence of 24 new fintech unicorns in 2019: 8 fintech startups including Next Insurance, Bight Health, Flywire, High Radius, Ripple, and Figure attained the unicorn status in Q4 2019, and 16 others made it to the list throughout the rest of the last year.

The fintech market globally today has 67 unicorns as of earlier this month (CB Insights)

- Insurtech sector, or startups such as Lemonade, Hippo, Next, Wefox, Bright Health that are offering insurance services, got a major boost last year. They raised 6.2 billion last year, up from $3.2 billion in 2018.

- Startups building solutions such as invoicing and taxing services and payroll and payments solutions for small and medium businesses also received the nod of VCs. In the U.S. alone, where more than 140 startups are operating in the space, raised $4 billion. In many more markets, such startups are beginning to emerge. In India, for instance Open and NiYo are building neo-banks for small businesses and they both raised money last year.

- Nearly 50% of all funding to fintech startups was concentrated in 83-mega rounds (those of size $100 million or above.): According to the research firm, 2019 was a record year for such rounds across the globe, except in Europe.

2019 saw 83 mega-rounds totaling $17.2B, a record year in every market except Europe

- Funding of Germany-based startups reached an annual high: 65 deals in 2019 resulted in $1.79 billion raise, compared to 56 deals and raise of $757 million in 2018, and 66 deals and $622 million raise in 2017.

- Financial startups in Southeast Asia (SEA) raised $993 million across 124 rounds in 2019 in what was their best year.

*CB Insights report includes a $666 million financing round of Paytm . It was incorrectly reported by some news outlets and the $666 million raise was part of the $1 billion round the Indian startup had revealed weeks prior. We have adjusted the data accordingly.

- Details

- Category: Technology Today

Read more: Fintech startups raised $34B in 2019

Write comment (97 Comments)As Samsung (re)unveiled its clamshell folding phone last week, I kept seeing the same question pop up amongst my social circles: why?

I was wondering the same thing myself, to be honest. I&m not sure even Samsung knows; they&d win me over by the end, but only somewhat. The halfway-folded, laptop-style &Flex Mode& allows you to place the phone on a table for hands-free video calling. Thatpretty neat, I guess. But… is that it?

The best answer to &why?& I&ve come up with so far isn&t a very satisfying one: Because they can (maybe). And because they sort of need to do something.

Lettime-travel back to the early 2000s. Phones were weird, varied and no manufacturers really knew what was going to work. We had basic flip phones and Nokia indestructible bricks, but we also had phones that swiveled, slid and included chunky physical keyboards that seemed absolutely crucial. The Sidekick! LG Chocolate! BlackBerry Pearl! Most were pretty bad by todaystandards, but it was at least easy to tell one model from the next.

(Photo by Kim Kulish/Corbis via Getty Images)

Then came the iPhone in 2007; a rectangular glass slab defined less by physical buttons and switches and more by the software that powered it. The device itself, a silhouette. There was hesitation to this formula, initially; the first Android phones shipped with swiveling keyboards, trackballs and various sliding pads. As iPhone sales grew, everyone elsebuttons, sliders and keyboards were boiled away as designers emulated the iPhoneform factor. The best answer, it seemed, was a simple one.

Twelve years later, everything has become the same. Phones have become… boring. When everyone is trying to build a better rectangle, the battle becomes one of hardware specs. Which one has the fastest CPU? The best camera?

- Details

- Category: Technology Today

Read more: Do phones need to fold

Write comment (92 Comments)

- Details

- Category: Technology Today

Read more: Celebrities turn up to protest Assange extradition

Write comment (90 Comments)

Some of Latin Americaleading venture capital investors are now backing hotel chains.

In fact, Ayenda, the largest hotel chain in Colombia, has raised $8.7 million in a new round of funding, according to the company.

Led by Kaszek Ventures, the round will support the continued expansion of Ayendachain of hotels in Colombia and beyond. The hotel operator already has 150 hotels operating under its flag in Colombia and has recently expanded to Peru, according to a statement.

Financing came from Kaszek Ventures and strategic investors like Irelandia Aviation, Kairos, Altabix and BWG Ventures.

The company, which was founded in 2018, now has more than 4,500 rooms under its brand in Colombia and has become the biggest hotel chain in the country.

Investments in brick and mortar chains by venture firms are far more common in emerging markets than they are in North America. The investment in Ayenda mirrors big bets that SoftBank Group has made in the Indian hotel chain Oyo and an investment made by Tencent, Sequoia China, Baidu Capital and Goldman Sachs, in LvYue Group late last year, amounting to &several hundred million dollars&, according to a company statement.

&We&re seeking to invest in companies that are redefining the big industries and we found Ayenda, a team that is changing the hotelindustry in an unprecedented way for the region&, said Nicolas Berman, Kaszek Ventures partner.

Ayenda works with independent hotels through a franchise system to help them increase their occupancy and services. The hotels have to apply to be part of the chain and go through an up to 30-day inspection process before they&re approved to open for business.

&With a broad supply of hotels with the best cost-benefit relationship, guests can travel more frequently, accelerating the economy,& says Declan Ryan, managing partner at Irelandia Aviation.

The company hopes to have more than 1 million guests in 2020 in their hotels. Rooms list at $20 per-night, including amenities and an around the clock customer support team.

Oyostory may be a cautionary tale for companies looking at expanding via venture investment for hotel chains. The once high-flying company has been the subject of some scathing criticism. As we wrote:

The New York Times published anin-depth report on Oyo, a tech-enabled budget hotel chain and rising star in the Indian tech community. The NYT wrote that Oyo offers unlicensed rooms and has bribed police officials to deter trouble, among other toxic practices.

Whether Oyo, backed by billions from theSoftBankVision Fund, will become IndiaWeWork is the real cause for concern. Indiastartup ecosystem is likely to face a number of barriers as itgrowsto compete with the likes of Silicon Valley.

- Details

- Category: Technology Today

Read more: Investors in LatAm get bitten by the hotel investment bug as Ayenda raises $8.7 million

Write comment (92 Comments)

At times, it can be hard to tell exactly who &Locke - Key& was made for.

Adapted from a comic book series written by Joe Hill and illustrated by Gabriel Rodriguez, the show tells the story of the Locke family after they move into the mysterious Keyhouse, where they soon discover hidden keys that can be used for a variety of magical purposes.

With its emphasis on adolescent romance and magical powers, &Locke - Key& often feels like a young adult adaptation, but it also strays into darker territory, with plenty of horror, as well as a persuasive focus on the familyongoing trauma following the violent death of husband/father Rendell Locke.

Despite some quibbles, your Original Content podcast hosts agree that the show manages to balance these different elements effectively, with surprising plot twists, creepy visuals and a particularly compelling sibling relationship between the two teenaged Lockes, Tyler (played by Connor Jessup) and Kinsey (Emilia Jones).

In addition to reviewing the show, we also discuss the announcement that Netflix has acquired Adam McKaynext film, &Don&t Look Up,& which will star Jennifer Lawrence. We had less to say about the movie itself and more about our respective attitudes towards a potential asteroid apocalypse.

You can listen in the player below, subscribe using Apple Podcastsor find us in your podcast player of choice. If you like the show, please let us know by leaving a review on Apple. You can also send us feedback directly. (Or suggest shows and movies for us to review!)

And if you want to skip ahead, herehow the episode breaks down:

0:00 Intro 0:35 &Don&t Look Up& discussion 14:19 &Locke and Key& spoiler-free review 29:48 &Locke and Key& spoiler discussion

- Details

- Category: Technology Today

Read more: Original Content podcast: Netflix‘Locke Key& offers spooky delights

Write comment (90 Comments)

SpaceX is looking to raise around $250 million in new funding according to a new report from CNBCMichael Sheetz. The additional cash would bring SpaceXtotal valuation to around $36 billion, according to CNBCsources — an increase of more than $2.5 billion versus its most recently reported valuation.

The rocket launch company founded and run by Elon Musk is no stranger to raising large sums of money — it added $1.33 billion during 2019 (from three separate rounds). In total, the company has raised more than $3 billion in funding to date — but the scale of its ambitions provides a clear explanation of why the company has sought so much capital.

SpaceX is also generating a significant amount of revenue: Its contract to develop the Crew Dragon spacecraft as part of the NASA commercial crew program came with $3.1 billion in contract award money from the agency, for example, and it charges its customers roughly $60 million per launch of one of its Falcon 9 rockets. Last year alone, SpaceX had 13 launches.

But SpaceX is also not a company to rest on its laurels, or its pre-existing technology investments. The company is in the process of developing its next spacecraft, dubbed &Starship.& Starship will potentially be able to eventually replace both Falcon 9 and Falcon Heavy, and will be fully reusable, instead of partially reusable like those systems. Once itoperational, it will be able to provide significant cost savings and advantages to SpaceXbottom line, if the companyprojections are correct, but getting there requires a massive expenditure of capital in development of the technology required to make Starship fly, and fly reliably.

Musk recently went into detail about the companyplans to essentially build new versions of Starship as fast as itable, incorporating significant changes and updates to each new successive version as it goes. Given the scale of Starship and the relatively expensive process of building each as an essentially bespoke new model, it makes perfect sense why SpaceX would seek to bolster its existing capital with additional funds.

CNBC reports that the funding could close sometime in the middle of next month. We reached out to SpaceX for comment, but did not receive a reply as of publication.

- Details

- Category: Technology Today

Page 1353 of 1378

15

15